My Cart 0

My Cart 0

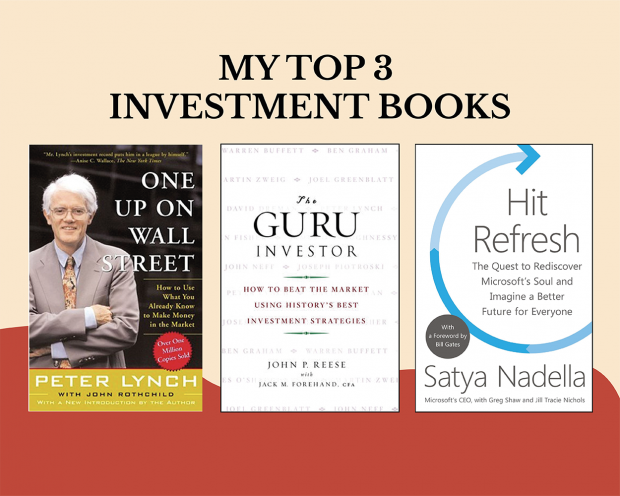

My Top 3 Investment Books

13 Feb 2021

While I studied in Banking & Finance and Accountancy in school, the best investing knowledge I got was from the books of other investors. This is not to say that the knowledge we learnt in school is useless, but it provides us with the basic fundamentals on how to read the financial statements and value the companies (Discounted Cashflow or Relative Valuation etc).

Over the years, I have scanned quite a few investment books. Below are the top 3 investment books that left the deepest impression on me.

1. One Up On Wall Street - by Peter Lynch

As one of the most famous investors of all time, this classic was among the top read in my list. The classification of the companies into different categories, while obvious can sometimes be oblivion to beginners. It is a good starting ground for investors to decide which type of stocks is most suitable for you, based on your character, and start active looking for them.

The 6 types of companies are:

- Slow growers

- Fast growers

- Stalwarts

- Cyclicals

- Turnarounds

- Asset plays

2. The Guru Investor - by John P. Reese with Jack M. Forehand

This is not the among the classics, but it is hands down my most favorite investment book. Every investor wants to find what is the holy grail to find the perfect stock. Well, there just isn’t a one size fits all solution. However, this book does compile the selection criteria used by some of the most famous investors of all time (eg. John Neff, Martin Zweig, Joel Greenblatt etc). While it may not always be practical to use some of these criteria in entirety, it help to shape some of the metrics and filters that I use when I look at a company.

The top criterias that I look out for includes:

- Cashflow (operating, investing and free cash flow)

- Net debt to equity

- Revenue and earnings growth

- The size and trend of profit margins

- Dividend payout ratio and trend

- Management

3. Hit Refresh - Satya Nadella

This is not exactly an investment book, but I believe the concepts behind it is applicable to life as well as in investment. This is a book by the current CEO of Microsoft, Satya Nadella, which talks about his life story from his childhood in India to ultimately becoming the CEO of Microsoft. Under Satya’s leadership, Microsoft reinvented itself to help the tech giant remain relevant.

One of the main themes highlighted in the book is the importance of empathy which drive the innovation behind Microsoft’s transformation. It is the ability to understand customers’ unarticulated and unmet needs to drive the innovation to come out with the great products to satisfy these needs. Products that solve the needs of users will ultimately sell themselves, driving profitability and make the basis of a good investment.