My Cart 0

My Cart 0

Market talk for the week (3 May)

07 May 2021

What happened in markets this week, and what are analysts talking about?

MC Payment

RHB issued its Top 20 small-cap jewels for 2021, and MC Payment was part of this year's series.

• RHB; Shekhar Jaiswal: MC Payment is the first SGX-listed proxy to growth in the ASEAN digital payments industry, providing an integrated digital payment infrastructure for merchants by offering a one-stop solution to accept all forms of digital payment and enabling them to run their businesses both online and offline. The house believes that MC Payment is a good proxy to e-payment growth in ASEAN, amidst the rising household income and increasing online commerce, underlying the need for economies to go cashless. The house also notes that, MC Payment's closest ASEAN listed peer, GHL SYstems has seen earnings growth at 33% CAGR, and share price performance of 300% return in 5 years.

Marco Polo Marine

RHB issued its Top 20 small-cap jewels for 2021, and Marco Polo Marine was part of this year's series.

• RHB; Jarick Seet : The house sees Marco Polo Marine as an Oil and Gas turnaround play having reversed from a loss of S$3.9m in FY18 to a positive EBITDA of S$2.4m in FY19. With a brighter outlook, the house sees a return to profitability in FY20-21F as highly possible with a continued pick-up in ship chartering, and ship repair/building activities. The house sees potential for a strong re-rating for the stock once profitability starts to kick in. Currently, the house believes Marco Polo Marine holds deep value where the Group is in a net cash balance sheet, and currently trading below significantly impaired NAV, and white knights' and creditors' entry price.

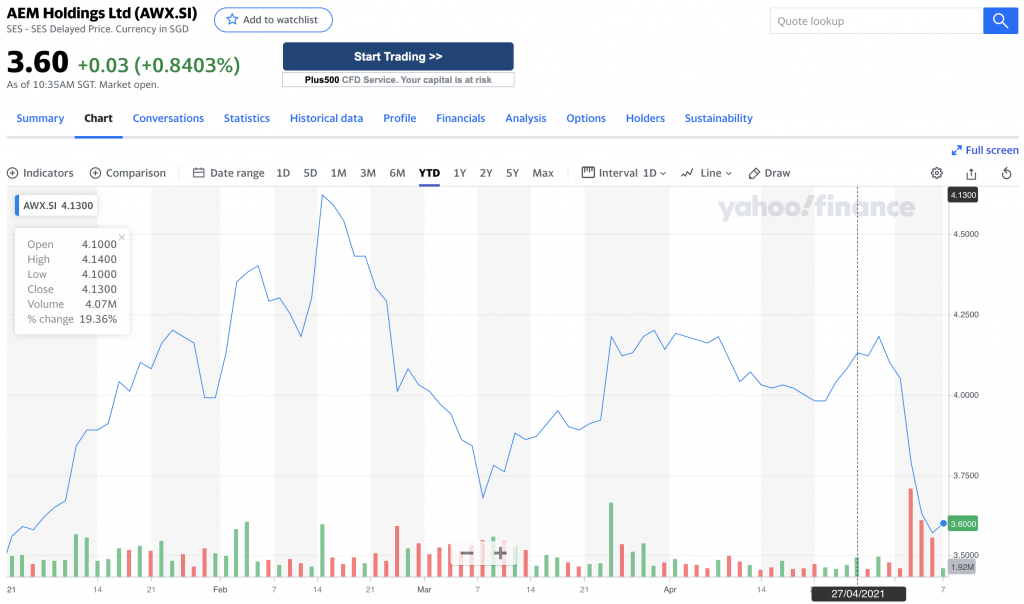

AEM

•Maybank; Gene Lih Lai: 1Q21 net profit was weaker than expected due to tougher comparison year on year, and cyclical softness ahead of volume ramp of new generation test handlers. The house increase TP to S$5.56 to roll forward to 14x FY22F PE, as it believes investors should focus on recovery potential of the Group.

•KGI; Kenny Tan: Maintain Outperform but with lower TP of S$4.36. Believes that long term prospects remain bright but there is limited near term upside to share price. Expect catalysts in 2H21 from potential surprise in orders inflow.

•CIMB; William Tng: Reiterate Add with unchanged TP of S$4.63. AEM expects 1H21 financial performance to be weaker yoy, but guided for a stronger 2H vs 1H. House sees share price weakness as a chance to add.

For our more info on markets and access to stock research, pls open a trading account with our preferred broker or subscribe to us. PM @moneyplantt at Telegram or email us at connect@gem-comm.com