My Cart 0

My Cart 0

Market talk for the week (12 April)

16 Apr 2021

What happened in markets this week, and what are analysts talking about?

Alibaba Group

China authorities imposed a record antitrust fine of US$2.8 billion on Alibaba Group, representing 4% of the Group’s 2019 revenue. This is triple of the previous US$975 million fine by Qualcomm in 2015, but far less than the maximum 10% allowed under Chinese law.

• Bloomberg: Fine may lift the regulatory overhang that has weighed on the company since late December 2020. Alibaba may have to be conservative with acquisitions and broader business practices.

• Morgan Stanley: Fine represent 6% of Alibaba’s current net cash and 0.5% of its market cap. The regulatory decision should lift a major overhang on the stock and the decision come without Alibaba having to make significant structural or asset divestures which may affect its core competence.

• Nomura: Fine while painful is a manageable one off expense for Alibaba. Conclusion of the investigation allows the Group to move on from the regulatory turmoil and recast the focus back to its business. Believes Alibaba is one of the cheapest big cap names in China’s internet space and the current risk reward looks attractive.

Frasers Logistics & Commercial Trust

Frasers Logistics & Commercial Trust (FLCT) has been included in STI from 13 Apr 2021. According to CIMB, they estimate FLCT’s weight in STI to be about 1.14%.

• CIMB; Lock Mun Yee and Eling Kar Mei: High conviction call, as they like FLCT’s “visible inorganic growth potential and income resilience, backed by a long WALE (weighted average lease expiry) profile.” CIMB likes FLCT for its stable portfolio which is supported by its robust industrial segment underpinned by pick-up in economic activity and a stable commercial segment as Singapore ease workplace restrictions. BUY recommendation with target price of S$1.57.

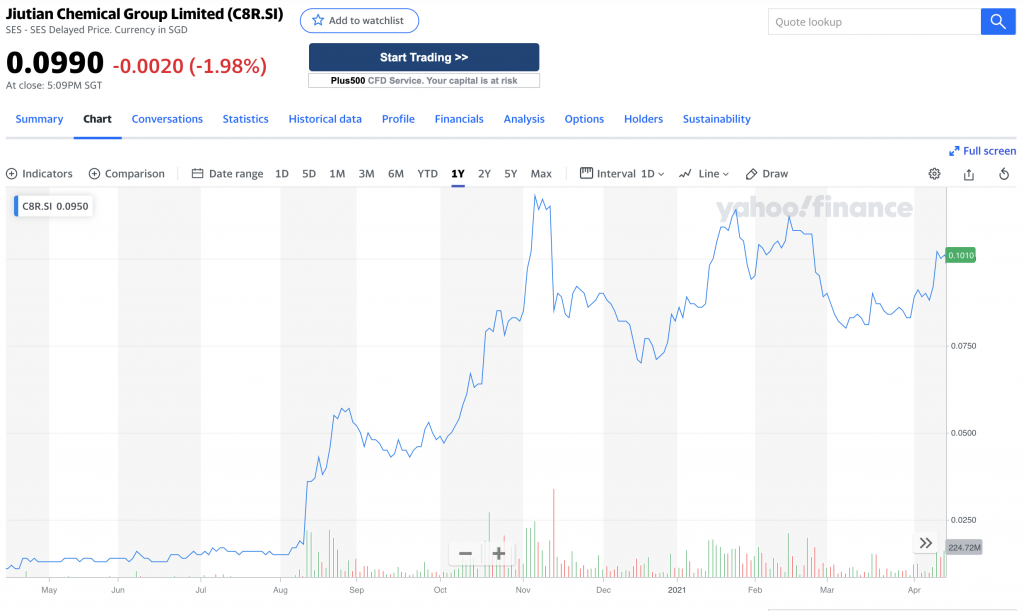

Jiutian Chemical

Prices of Dimethylformamide (DMF) has been on strong uptrend year to date (gaining about 40% year to date) in China. Jiutian is the second largest DMF producer in China. Jiutian also produces methylamine, together with DMF, these chemicals are used in various industries including consumer goods, petrochemicals etc.

• CIMB; Ong Khang Chuen and Kenneth Tan: 1Q21F earnings preview- expect another quarter of record profits with core net profit of RMB78.5m (>28x increase yoy). Reiterate Add, as expect Jiutian to enjoy strong earning in 1H21F, and valuations being attractive at just 3.9x FY22F PE, backed by net cash of RMB110m as of end FY20 (about 11.6% of current market cap)

• KGI: Robust selling price of DMF may hint of upcoming 1Q21F results being a catalyst for the company, as Jiutian is scheduled to report in last week of April.

For our more info on markets and access to stock research, pls open a trading account with our preferred broker or subscribe to us. PM @moneyplantt at Telegram or email us at connect@gem-comm.com