My Cart 0

My Cart 0

Market talk for the week (12 July)

16 Jul 2021

What happened in markets this week, and what are analysts talking about?

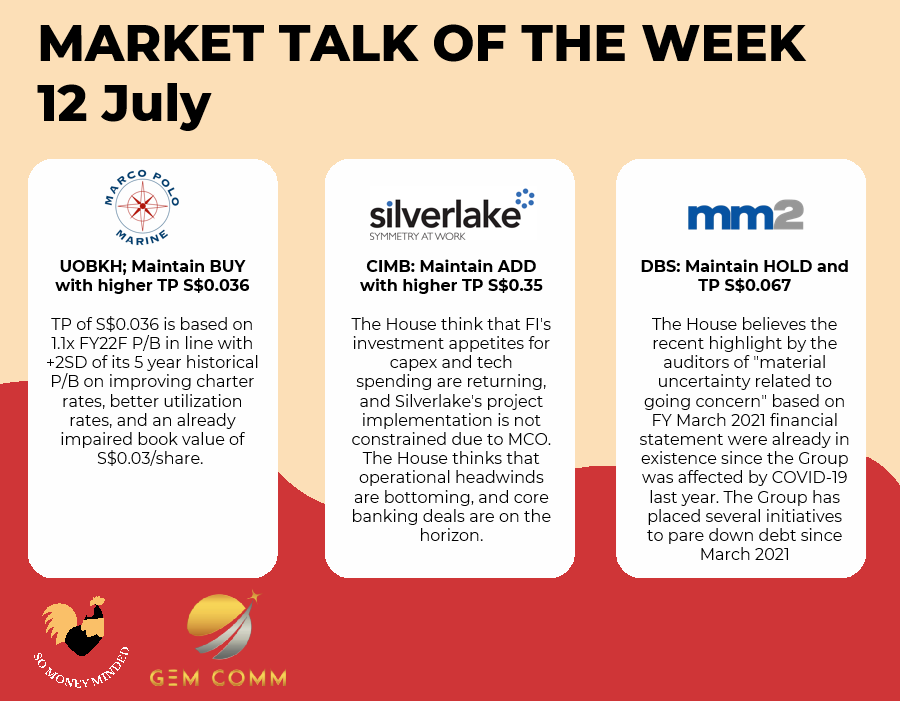

Marco Polo Marine

•UOBKH; Maintain BUY with higher TP S$0.036 The House noted the rationalised oil & gas offshore support industry showing resilience over the COVID-19 pandemic. The House likes MPM for its lean operations and a successful transition to new revenue sources would be a key turning point for the Group. TP of S$0.036 is based on 1.1x FY22F P/B in line with +2SD of its 5 year historical P/B on improving charter rates, better utilisation rates, and an already impaired book value of S$0.03/share.

Silverlake Axis

CIMB: Maintain Add with higher TP S$0.35 The House think that FI's investment appetites for capex and tech spending are returning, and Silverlake's project implementation is not constrained due to MCO. The House thinks that operational headwinds are bottoming and core banking deals are on the horizon.

mm2 Asia

•DBS; Maintain HOLD and TP S$0.067. The House believes the recent highlight by the auditors of "material uncertainty related to going concern" based on FY March 2021 financial statement were already in existence since the Group was affected by COVID-19 last year and view it as a prudent measure on the part of auditor. The Group has placed several initiatives to pare down debt since FYMarch 2021 including spinoff of cinema business, merger of cinema business with GV, launch of rights issue which was completed in April 2021 and entry of strategic investor to deleverage. The Group has also been engaging with various lenders for refinancing of its existing loans and to seek new credit facilities to secure financial sustainability where negotiations are still in progress.

For our more info on markets and access to stock research, pls open a trading account with our preferred broker or subscribe to us. PM @moneyplantt at Telegram or email us at connect@gem-comm.com