Link to Report:

🌟BROKER’S Updates🌟

Maybank Analyst: Jarick Seet

Dyna-Mac – Explosive 1H24 🇸🇬⛴️⚓️🛢️ ( DHML SP , BUY , TP 0.64 ⬆️ from SGD0.62 )

“Dyna-Mac’s 1H24 results are spectacular, with revenue rising 43% YoY to SGD260m and NPAT up 280% YoY to SGD39m, achieving 66% of our FY24 forecasts, led by a surge in gross profit margin from 13.5% to 27.6% as well as solid revenue growth. We raise our FY24E PATMI by 3.6% and FY25E by 3.7% and increase our TP to SGD0.64 from SGD0.62, based on 13x FY24E P/E. Dyna-Mac is a key beneficiary of the multi-year FPSO upcycle and remains one of our Top Picks in the SMID space.”

- Surge in margins and profitability

- Larger orders likely with higher margins

- Remains One of our Top SMID Picks

Li Jialin and Eric Ong of Maybank Securities have kept their “buy” call and 45 cents target price for LHN after the co-living operator announced it is adding two new developments to its portfolio.

First, LHN won a government tender for the former Bukit Timah fire station, which will be refurbished at a cost of $7 million to become a mixed-use project with 60 serviced apartment units on levels 2 & 3, and a ground floor commercial F&B and retail operation.

According to LHN, this site will serve as a key community node for both the Rail Corridor and the surrounding precinct and is expected to be open by June 2025.

“In our view, the Bukit Timah project should capitalize on LHN’s expertise and synergy across its business units in co-living, commercial and facility management,” write Li and Ong in their April 11 note.

Meanwhile, LHN is also teaming up with Oxley Holdings 5UX 0.00% CEO Ching Chiat Kwong and his son Shawn Ching in a 50-50 joint venture to acquire Wilmer Place, which is at 50 Armenian Street, near the City Hall MRT.

According to the Maybank analysts, the office building could remain as a commercial building or be re-purposed for LHN’s co-living business.

With a land area of 710.7 sqm, the leasehold building has a tenure of 99 years from 1 May 1947. This should enable the LHN, which is spending up to $24 million for this project, to expand its co-living offerings under its space optimization business segment.

In total, LHN has 6 upcoming projects, including the Ministry of Health hostel for 700 nursing professionals.

To help fund this growth, LHN is offering commercial paper of up to $5 million, at a 6% interest rate

With MOH proposing another 11 other sites, this suggests possible re-rating catalysts for LHN if it can secure more of these projects, according to the Maybank analysts.

Their target price of 45 cents is pegged at 8 times forward FY2024 earnings.

LHN shares changed hands at 34 cents as at 2.05pm, up 1.52% for the day.

Established in 1991, Marco Polo Marine is an integrated marine logistics company that provides a wide range of services to the offshore oil and gas, and renewable energy sectors.

The company has reported a strong performance for its financial year ended 30 September 2023 (FY2023). In this article, we will zoom into its financial results, growth prospects, valuation and more.

Powered By Twin Growth Engines

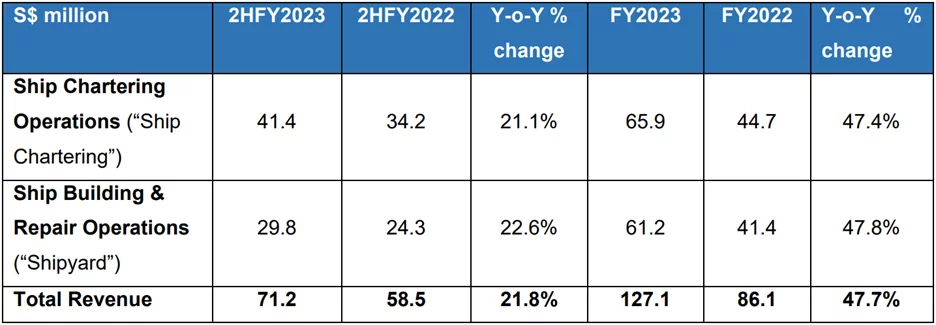

Marco Polo Marine operates 2 main business segments:

1) Ship Chartering Division relating to the chartering of Offshore Supply Vessels (OSVs), tugboats and charters, and

2) Shipyard Division relating to shipbuilding and provision of ship maintenance, repair, outfitting, and conversion services.

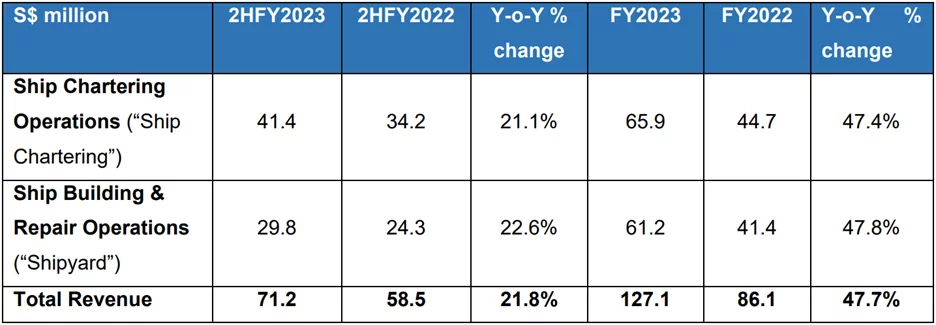

For FY2023, Ship Chartering revenue experienced a significant 47.4% year-on-year jump to S$65.9 million from S$44.7 million in the previous year.

The principal factor contributing to this boost was the complete consolidation of PT Bina Buana Raya (“PT BBR”) and PKR Offshore’s (“PKRO”) results in the ongoing financial year, as opposed to the partial consolidation in FY2022. It’s noteworthy that PT BBR and PKRO officially became subsidiaries of the Group in March and May 2022, respectively.

To add on, the revenue from Shipyard segment also exhibited a stellar 47.8% year-on-year increase to S$61.2 million as compared to the previous year, driven by higher contract values associated with repair projects and the initiation of new ship-building projects.

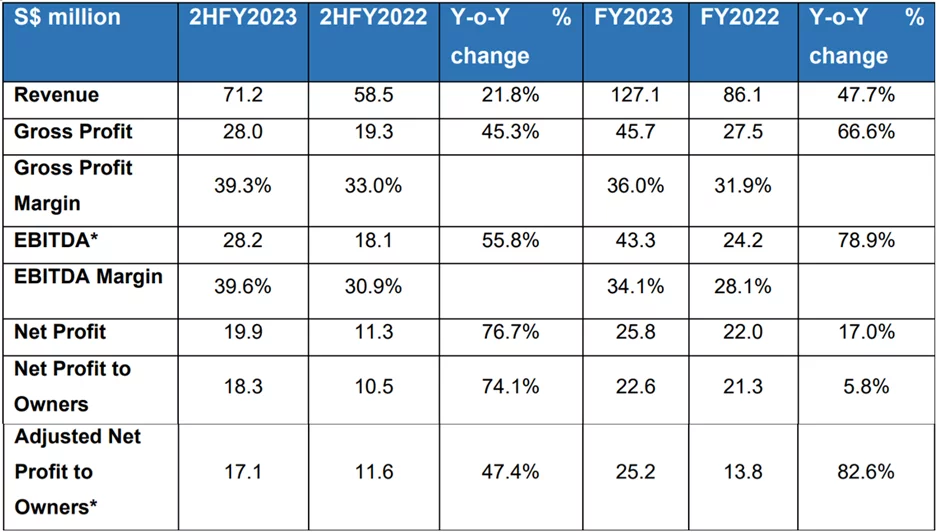

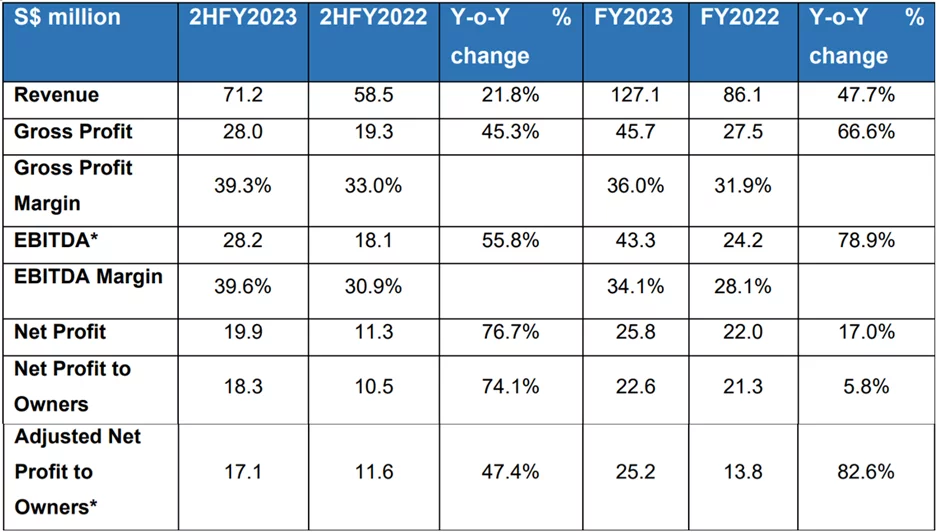

Consequently, Marco Polo Marine reported a substantial 78.9% year-on-year growth in EBITDA to reach S$43.3 million, underpinned by the higher revenue and better gross profit margins.

Excluding FX gains/losses and one-off items, the group’s adjusted net profit to owners saw a spectacular 82.6% jump from S$13.8 million in FY2022 to S$25.2 million in FY2023.

With that in mind, Marco Polo Marine is a leading integrated marine logistics group The company operates in Singapore, Indonesia, Malaysia, and other parts of Southeast Asia, and has been listed on the Singapore Exchange since 2007.

Stellar Growth Prospects

For the Shipyard business, the growth continues to be propelled by elevated contract values for ship repair projects and the securing of contracts to build several barges with progressive deliveries up to 2HFY2024.

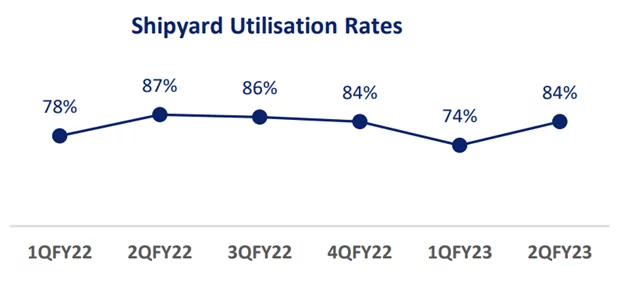

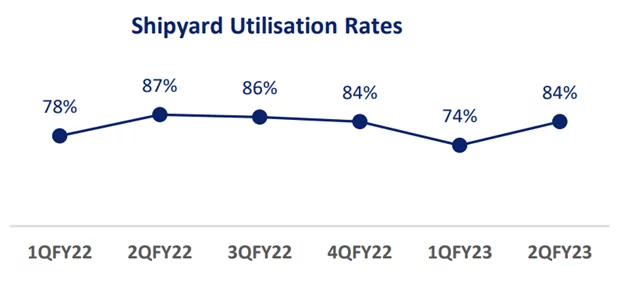

The shipyard’s average utilisation rate stands at 84% in the 2Q FY2023 and has remained relatively stable in the past year as well.

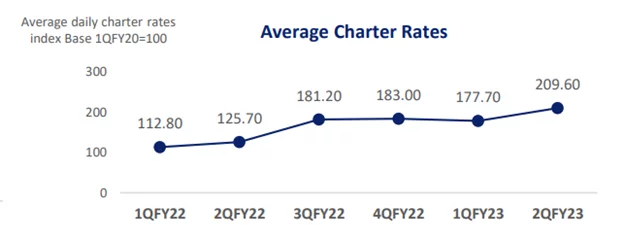

For the Ship Chartering business, revenue growth has surged due to higher vessel utilisation and increased charter rates.

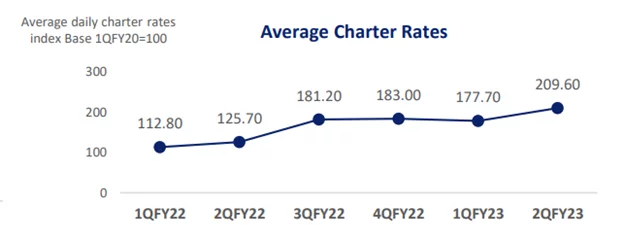

As seen from the chart above, average charter rates have climbed steadily from 112.80 points in 1Q FY2022 to 209.60 points in 2Q FY2023.

The trend for the ship chartering segment of Marco Polo Marine is positive, as the company expects to see sustained demand for its vessels, especially in the Asia’s offshore wind farm sector, which is expected to grow rapidly in the coming years.

On this note, Marco Polo Marine has established a strong presence in the offshore windfarm division through its partnership with Oceanic Crown Offshore Marine Services Ltd. and by acquiring PKR Offshore Co. Ltd.

The Group has also been securing significant opportunities in the offshore wind farm sector and has achieved notable milestones, including:

- Building its inaugural Commissioning Service Operation Vessel (CSOV), slated for completion in the first quarter of 2024.

- Establishing a Memorandum of Understanding (MOU) with Vestas Taiwan for the CSOV’s charter.

- Venturing into the Japanese market with a groundbreaking MOU signed with “K” Line Wind Service, Ltd (KWS).

- Making its debut in the South Korean market through MOUs with Namsung Shipping Co., Ltd. (Namsung) and HA Energy Co., Ltd. (HA-E) on January 11, 2023.

According to marketsandmarkets.com, the global offshore wind farm market was valued at US$31.8 billion in 2021, and is projected to reach US$56.8 billion by 2026, registering a compound annual growth rate (CAGR) of 12.3% from 2021 to 2026. This bodes well for the company.

To top it off, things are also picking up in the oil and gas markets, and this is expected to boost the charter rates for their offshore support vessels in the coming financial year.

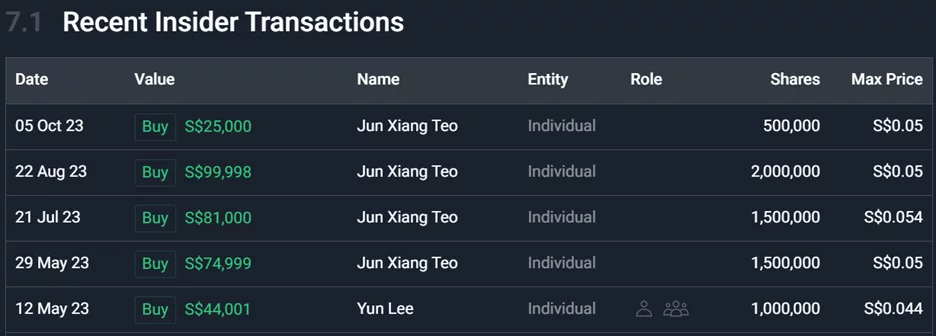

Notable Recent Purchases by Company Insiders

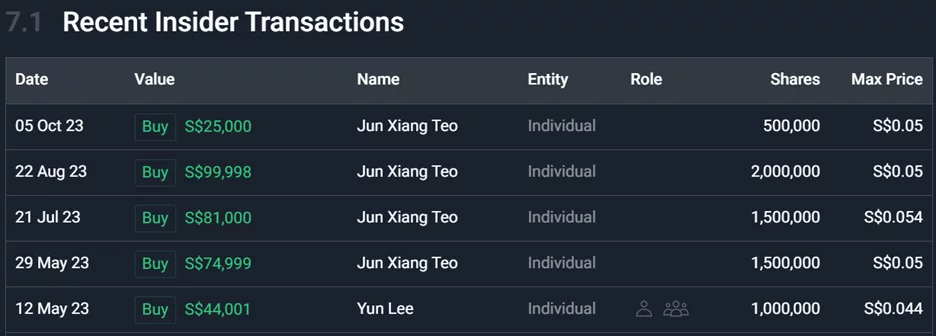

In the year 2023 itself, we have 2 notable recent purchases from 2 individuals. Mr. Yun Lee, CEO of the firm, has acquired 1 million shares from the open market on 12 May 2023.

On top of that, Mr. Teo Jun Xiang, Non-Executive Director and Managing Partner of family office Apricot Capital, has been on an acquisition spree, snapping up a total of 5.5 million shares in the past year.

What’s worth noting is that his purchase prices are all above 5 Singapore cents, which means shareholders are getting a bigger bang for their buck since the stock is trading at S$0.048 at the time of writing.

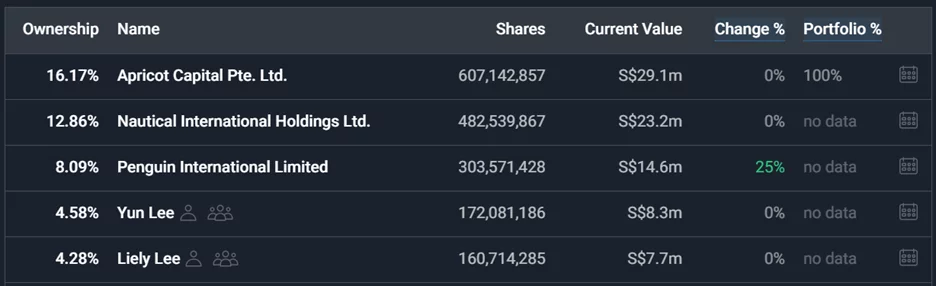

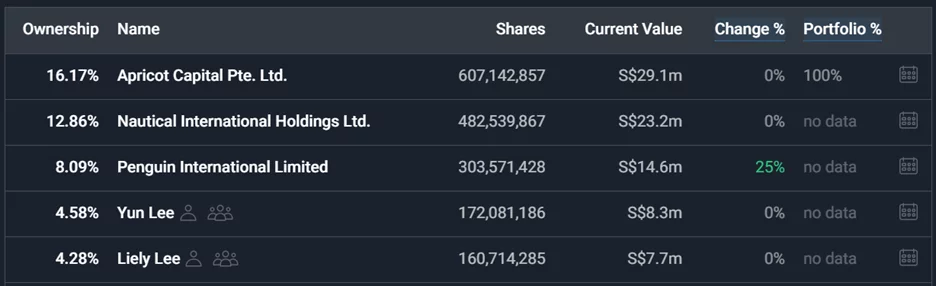

Furthermore, Apricot Capital and CEO Mr. Yun Lee own a sizable 16.17% and 4.58% stake in Marco Polo Marine respectively, which gives them the incentive to grow the business because they have the biggest vested interest of all.

Valuation backed by hard assets

As of 30 September 2023, the Group is also sitting on a cash balance of S$63.1 million. Deducting the total borrowings of S$2.3 million, it equates to a strong net cash position of S$60.8 million.

This provides the Group with the financial flexibility to continue expanding its footprint in the thriving offshore wind farm market. On top of that, the company wishes to celebrate this achievement by rewarding shareholders with a dividend of S$0.001 per share, equivalent to an estimated 2.1% dividend yield.

In addition, the Group’s valuation is also primarily backed by hard assets including cash, OSVs and its Batam shipyard. As of 30 September 2023, the Group has a net asset value of S$0.043 per share, translating into a Price/Book of 1.1x.

Conclusion

In conclusion, Marco Polo Marine has demonstrated a robust FY2023 performance with its top- and bottom-line increasing double digits on a year-to-year basis.

We can also see how the expansion into offshore windfarm markets in Asia and recent insider purchases underscore confidence in the company’s prospects.

As the company continues to navigate the dynamic marine logistics landscape, investors can look forward to potential value creation and sustained growth.

My Cart 0

My Cart 0