My Cart 0

My Cart 0

BROKER’S REPORT

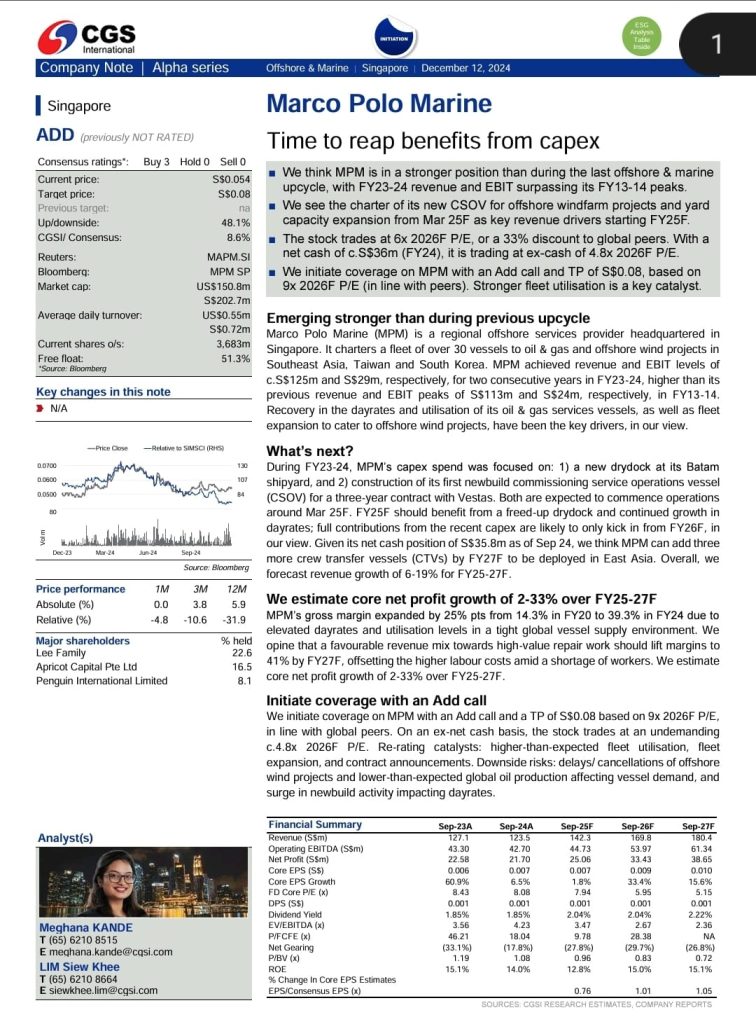

CGS Research INITIATION on MARCO POLO MARINE (SGX: 5LY)

CGS initiates coverage on MPM with an Add call and TP of S$0.08, based on

9x 2026F P/E (in line with peers). Stronger fleet utilisation is a key catalyst.

📈Time to reap benefits from capex

MPM is in a stronger position than during the last offshore & marine

upcycle, with FY23-24 revenue and EBIT surpassing its FY13-14 peaks.

The charter of its new CSOV for offshore windfarm projects and yard

capacity expansion from Mar 25F as key revenue drivers starting FY25F.

The stock trades at 6x 2026F P/E, or a 33% discount to global peers. With a

net cash of c.S$36m (FY24), it is trading at ex-cash of 4.8x 2026F P/E.

- its product or service offering

- its financial track record,

- its competitive advantage,

- its strategy, and

- the credibility of the company’s plan to execute its strategy.”

- Consumer

- Real Estate

- Logistics

- Manufacturing

Unlock the Power of Global Investor Relations! 🌐💼

At Gem Comm, we bridge the communication gap for companies with a global footprint, like our client Procurri – listed on SGX since 2016 and with a CEO based in the US. 🇸🇬🇺🇸

𝗣𝗿𝗼𝗰𝘂𝗿𝗿𝗶’𝘀 𝗠𝗿 𝗝𝗼𝗿𝗱𝗮𝗻 underscores the importance of tapping Gem Comm’s familiarity with the nuances of SGX and the local investor community. This strategic partnership allows Procurri to better articulate its messaging and vision with clarity, transcending geographical boundaries even while Mr Jordan leads from the US.

Gem Comm’s expertise lies in seamlessly connecting businesses with their investors, no matter where they are. We help listed clients like Procurri uphold the highest reporting and disclosure standards while fostering close communication channels on the ground.

By leveraging on our tailored investor relations strategies, we cultivate trust, nurture enduring connections, and unlock lasting value for companies and their stakeholders alike.

Trust Gem Comm to be your global investor relations partner – we can elevate your business to new heights while keeping your investors engaged and informed every step of the way! 🚀🌍

An interesting read from BT on the importance of Investor Relations (IR)

” Good IR will help companies to achieve sustained corporate performance and investor confidence in the equity market. Companies that communicate better and more responsively with their stakeholders will foster greater transparency and stronger corporate governance within the organisation.”

“In essence, investors would like to know, from the company’s communications with them, five things in particular:

SGX has announced earlier in the year that companies listed on the Singapore exchange will no longer be required to file quarterly reports, as long as they are not deemed to be of higher risks.

SGX has just released the list comprising of 109 companies which must continue to make quarterly reporting. See list here

With the exemption, mm2 Asia, Vividthree and UnUsUaL will be opting for half yearly reporting (1H and full year reporting)

Invest-101 Free Ebook

Click here to download your free e-book

Robo advisors, Regular share savings plan, DIY Investing?

With so many investment options out there, which is the best one for a beginner investor?

Find out more from our free e-book designed for the beginner investor in mind.

Happy Reading and Investing! And Merry Christmas!

Access to Article: GEM News 18 Global M&A 160819

The most discussed topic recently…

Buyouts/ Takeovers continued to be very active in 2018, notwithstanding the introduction of volatility in various markets. The wheeling and dealing has clustered around Technology, Healthcare and Business Services sectors, encompassing 68% of the total USD4.1 trillion in M&A values in 2018. Bristol Myers Squibb proposed USD74 billion acquisition of Celgene currently places it in pole position as the top M&A activity for 2019.

Singapore’s transaction volumes have remained relatively stable since 2016 to 2018, with an uptick in deal value seen in 2018. Close to 50% of Singapore delisting deals have been triggered by owners/management-led initiatives like the recent delisted Cityneon Holdings and Memtech International. There are also more private equity firms eyeing on Singapore buyout in these couple of years.

In this article, we highlight notable de-listing deals since 2014 in the four key sectors:

Potential Candidates

There are various brokerage firms (RHB, DBS, KGI) who highlighted a few potential companies for privatisation.

We have also included a list of potential privatization candidates based on our own assessment that their key valuation metrics demonstrate signs of potential under-valuation. Some of these counters spot attractive dividend yields as high as 8.4%, which makes them ideal buy-and-hold candidates as we await a possible privatization conclusion.

Will global political tensions, trade wars and turbulent markets ultimately derail the bullish global M&A trajectory seen over the past five years?

We provide free daily news update on the market and the economy on whatsapp and telegram.

To subscribe:

Join our telegram group: https://t.me/gemcomm

Join our whatsapp broadcast: txt hello to

https://api.whatsapp.com/send?phone=6587407951&text=&source=&data=

Service of: https://www.facebook.com/GEMCOMM.IR/

Pls let your friends know if you like our service. Thanks.

________________________________________________________

GEM Exclusive- Trading Idea-Hong Fok

Hong Fok

Mkt cap: $750m; Price: $0.87; P/B: 0.32x, Dividend yield: 1.1%, Net D/E: 29.5%

About: Primarily engaged in property investment, property development and construction, property management, investment trading and investment holding and management.

Trading idea- we love trading a stock with fundamentals. While there is deep value for the stock, value trap is always a concern. Hence, we are recommending this as a trading idea (till there is a clear path demonstrated to monetise its deep value)

Quick glance: Hongfok is a well-known value stock, given it is trading at only 0.3x P/B, and backed by investment properties such as the likes of International Plaza, Concourse and Yotel at Orchard.With its attractive valuation, a free float of only 29%, it is also a potential privatisation target. However, there are concerns that it may be a value trap, if there are no other way for shareholders to realise the deep value within Hongfok (other than the 1.1% dividend yield), which may also explain its depressed P/B. A 0.4-0.5x P/B will imply a TP of S$1.10-1.38

By the charts: After its surge earlier in the year, prices have corrected more than 20% before forming higher highs and higher lows. Stock seems to be currently supported at $0.85 as well as active share buybacks and repurchases from management/major shareholder. Assuming stock can break above its recent high of $0.895, hopefully it will be trending towards $0.94. On a weekly chart, if the stock is able to retest its previous high of $1.01, and break above, it may potentially chart towards $1.165 which will still put it within our “fundamental TP” range.

Stop loss $0.83

TP 1: $0.94

TP 2: $1.165

We provide free daily news update on the market and the economy on whatsapp and telegram.

To subscribe:

Join our telegram group: https://t.me/gemcomm

Join our whatsapp broadcast: txt hello to

https://api.whatsapp.com/send?phone=6587407951&text=&source=&data=

Service of: https://www.facebook.com/GEMCOMM.IR/

Pls let your friends know if you like our service. Thanks.

________________________________________________________

GEM Exclusive- Investment Idea-INNOTEK

INNOTEK Ltd.

Mkt cap: $118m; Price: $0.52, P/B: 0.77x, 2018 P/E: 5.8x, Ex-(cash+financial assets) 2018 PE: 2.4x; ~2-2.4x EV/EBITDA, Dividend yield: 2.9%

About: Precision metal components manufacturer serving mainly Office Automation, Automotive, TV & Display with over 40 years of operational history; Customers include major MNCs such as Ricoh, Canon, Continental, Sony, Innolux, Epson, Bosch, Innolux

Nearly 100% of Valuation backed by hard assets= Cash (S$0.257) + Investments (S$0.053) + Investment properties (S$0.120) + buildings and land only in PPE (S$0.07) = S$0.498

___________

Net cash of S$0.257/share as at 31 Mar 19 (after adjusting for S$0.01 dividend paid on 22 May 19)- forming about 50% of market cap-S$39.6m cash, S$20.7m in structured deposits (a combi of deposit and investment product, investors will receive 100% of principal if held till maturity). If you include the investment portfolio (equities, trusts, bonds etc) of S$12m, it will boost net cash + financial assets = S$0.310 (about 61% of mkt cap)

Strong Free cashflow generation- average S$0.043 of free cash generated/year in the last 3 FYs – notwithstanding any dividend payment and if innotek maintain its cashflow generation, it will take about 5 years for Innotek’s market cap to be fully backed by $.

Huge Turnaround attributable to savvy management- who came on board in late 2015, and the turnaround has almost been immediate, with Innotek successfully reversing from a loss in 2015 to a profit in 2016, before nearly doubling in profit (from 2016) to S$20m in 2018. It is always reassuring to see Management who are always adapting to market trends and not resting on their laurels, as in the case of Innotek – With good foresight, Management had diversified into heatsinks, automotive displays earlier on, which had helped to soften the impact of a declining trend where tradition metal TV bezels are being replaced by plastics. Similar can be said by management’s decision to set up a new facility in Thailand to be nearer to its customers (short term pain, long term gain), regaining market share for its office automation. Innotek is now looking to be an even more integral part of its customer’s supply chain as it transits from single component supply to assembly.

Management put his money where his mouth is. In 2016, Mr Lou (CEO) owns about 5.3% stake in innotek. He doubled his stake in the group in Jul 18 to 11.5% by acquiring shares in the group at S$0.40/share- tying his fate even more closely to shareholders.50% rise in dividends With the improvement in profit, Innotek has also rewarded shareholders with a 50% rise in dividends to S$0.015 for FY18, (a needle in its haystack of S$0.31 worth of $$)

Stellar 1QFY19 results with a 29% rise in gross profit, and a surge in net profit (amidst a low base) to S$3.9m. Free cashflow generated was super strong too (S$0.054/share). However, share price has fallen 15% since, on concerns of a weaker outlook from a slower Chinese economy and greater macro uncertainty.

What we think: While the outlook is more murky for cyclical stocks such as Innotek, its low valuation (one of the lowest among its peers, and also happened to be backed nearly 100% by hard assets (thinking from a liquidation perspective), gives Innotek a high margin of safety for investors. Investors can also sleep with a peace of mind that the company is currently run by a savvy management who have proven themselves over the last 3 years (including their ability to adapt to market trends) and also put his money where his mouth is, riding the up and downs with shareholders. With its cash flow generative nature, innotek will only get “cheaper” as time goes by as cash accumulates.

GEM FEATURE: HIGHLIGHTS FROM BERKSHIRE HATHAWAY ANNUAL MEETING

1) Buybacks: Berkshire repurchased $1.7b worth of shares in 1Q19 (more than 2H18), as its cash pile continue to swell to $114b. “We are going to be more liberal when it comes to repurchasing shares…we are certainly willing to spend $100 billion [on buybacks]” should Berkshire’s market value falls below intrinsic value

2) Amazon is a ‘value’ bet: Amazon rose on Friday after Buffett say Berkshire has been buying Amazon, although the decision was made by “one of the fellows in the office that manage money”, who took into consideration a slew of financial metrics. “The considerations are identical when you buy Amazon versus … say a bank stock that looks cheap against book value or earnings of some sort,”

3) Overpaying for Kraft Heinz: Heinz was at one-point Berkshire’s most valuable common stock investment but had lost more than 60% of its value since start of 2017, and recently delayed its 1Q earnings due to accounting issues. “Kraft Heinz is still doing very well operationally… I think the problem was that we paid a little too much for the last acquisition…. You can turn any investment into a bad deal by paying too much”

4) Caution on private equity: “We have seen a number of proposals from private-equity funds where the returns are really not calculated in a manner I would regard as honest….I would not get excited about so-called alternative investments.” It was recently reported that Buffet ‘looked’ at Uber investment 18 months ago, but passed. Uber is set to go public this month with a valuation of $83.8b on the high end of that range. Uber last raised money in the private market at a $76 billion valuation.

5) Berkshire after Buffett: At the CEO level, Berkshire has made Ajit Jain and Greg Abel vice chairmen, a move that was confirmed to be part of the succession plan. Jain oversees the conglomerate’s insurance businesses while Abel oversees non-insurance business operations.

GEM Exclusive- Investment Idea-PEC

PEC Ltd.

Price: $0.60; Mkt cap: $152.5m;

NAV: $0.898, Net cash/share: $0.255

P/B: 0.67x, 2018 P/E: 14.6x, Ex-cash PE: 8.4x,

Dividend yield: 3.3%

Free float: 33.4%

Value play- At 0.7x P/B, of which $0.255/share is net cash, $0.024 is investment property, $0.202 for accrued income (revenue from services earned but not invoiced yet), PPE of $0.304.

Receivables more than offset payable – Accrued income has been increasing from S$0.08/share (S$20m) in FY16 to currently S$0.184/share (S$47m) at end of FY18.

Maintenance income has been rising over the years- Rose by 50% from 2016 to $226m in FY18, 67% of total revenue. EBITDA margins for it has been stable to rising at 24.2% at 2018. The contracts due date maybe a risk to the Company

Solid order book of $279.4m as at end of 2018– This excludes maintenance contracts which form 67% of FY18 revenue. if we assume substantial of the order book will be recognised in 2019-2020, will translate to about $125m of annual revenue, (at least safely comparable to 2018). Orderbook is highest at least over the last 3 years. PEC recently secured another S$100m in new contracts in Apr 19.

A very positive outlook- Citing investments in Refining and Petrochem projects to come onstream in Asia and Middle east in next 5 years, and IMO decision to reduce bunker sulphur levels to 0.5% to result in investment by refiners to comply to the regulation.

Price supported by consistent share buybacks, In the meantime, 3% dividend yield to wait. Additionally, shareholders be rewarded with a small mini special dividend happened in 2016/2017, of 0.005 or 0.01, translates to 4-5%

Chartwise, after correcting from as high as $0.74, seem to have found a base at $0.56, amidst all the positive development and earnings, are prices ready to go higher? Prices have already broken higher with greater than average volume. If we assume profit revert back to about $18m (average of 2017 and 2016), it will be about 5-6x ex cash PE.

So far, profit has surged in 1H19, revenue +33%, GP +18%, Net profit +74%- attributable to revenue increase from project works and maintenance.