My Cart 0

My Cart 0

BROKER’S REPORT

CGS Research INITIATION on MARCO POLO MARINE (SGX: 5LY)

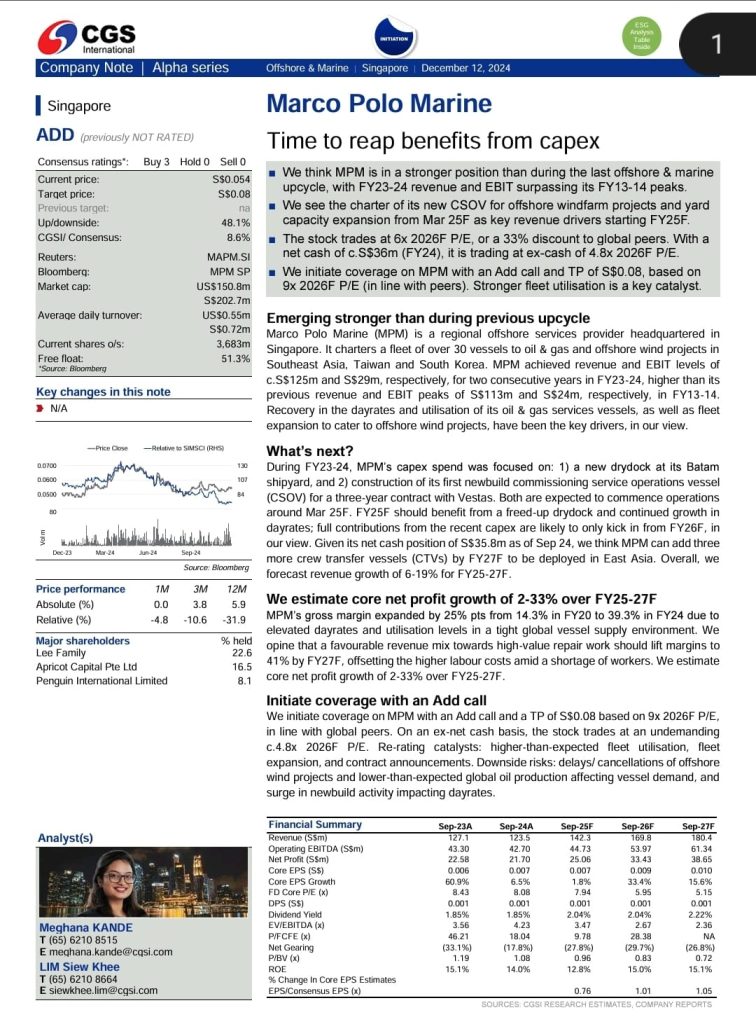

CGS initiates coverage on MPM with an Add call and TP of S$0.08, based on

9x 2026F P/E (in line with peers). Stronger fleet utilisation is a key catalyst.

📈Time to reap benefits from capex

MPM is in a stronger position than during the last offshore & marine

upcycle, with FY23-24 revenue and EBIT surpassing its FY13-14 peaks.

The charter of its new CSOV for offshore windfarm projects and yard

capacity expansion from Mar 25F as key revenue drivers starting FY25F.

The stock trades at 6x 2026F P/E, or a 33% discount to global peers. With a

net cash of c.S$36m (FY24), it is trading at ex-cash of 4.8x 2026F P/E.

Unlock the Power of Global Investor Relations! 🌐💼

At Gem Comm, we bridge the communication gap for companies with a global footprint, like our client Procurri – listed on SGX since 2016 and with a CEO based in the US. 🇸🇬🇺🇸

𝗣𝗿𝗼𝗰𝘂𝗿𝗿𝗶’𝘀 𝗠𝗿 𝗝𝗼𝗿𝗱𝗮𝗻 underscores the importance of tapping Gem Comm’s familiarity with the nuances of SGX and the local investor community. This strategic partnership allows Procurri to better articulate its messaging and vision with clarity, transcending geographical boundaries even while Mr Jordan leads from the US.

Gem Comm’s expertise lies in seamlessly connecting businesses with their investors, no matter where they are. We help listed clients like Procurri uphold the highest reporting and disclosure standards while fostering close communication channels on the ground.

By leveraging on our tailored investor relations strategies, we cultivate trust, nurture enduring connections, and unlock lasting value for companies and their stakeholders alike.

Trust Gem Comm to be your global investor relations partner – we can elevate your business to new heights while keeping your investors engaged and informed every step of the way! 🚀🌍

𝗠𝗿. 𝗦𝗲𝗮𝗻 𝗟𝗲𝗲, CEO of 𝗠𝗮𝗿𝗰𝗼 𝗣𝗼𝗹𝗼 𝗠𝗮𝗿𝗶𝗻𝗲, one of our esteemed clients, emphasises the significance of effective investor relations in keeping shareholders well-informed about the company’s performance, strategy, and future prospects, fostering understanding and trust. By gathering feedback from shareholders, the company enhances transparency and communication, fortifying its relationship with shareholders.

𝗠𝗿. 𝗟𝗶𝗺 𝗔𝗵 𝗖𝗵𝗲𝗻𝗴, CEO of 𝗗𝘆𝗻𝗮-𝗠𝗮𝗰 𝗛𝗼𝗹𝗱𝗶𝗻𝗴𝘀 𝗟𝘁𝗱 (SGX: NO4), one of our esteemed clients emphasises the significance of sharing company developments with shareholders, irrespective of whether the news is positive or negative. This practice ensures shareholders are well-informed about the company’s endeavours, which cultivates investor trust and engagement.

A Quick Recap on Digital Banks – GLDB

Digital banks in Singapore have revolutionized the financial sector, delivering customers a fresh and accessible banking experience. The emergence of these digital banks has reshaped the banking landscape, with the Monetary Authority of Singapore (MAS) granting licenses to four distinct digital banks in 2020:

On this note, Green Link Digital Bank (GLDB) is held by a consortium involving Greenland Financial, Linklogis Hong Kong, and Beijing Co-operative Equity Investment Fund Management.

Source: Lendingpot

These banks provide a diverse array of banking services, ranging from virtual banking to digital wealth management, catering specifically to the market’s needs.

While Digital Full Banks are allowed to take deposits from retail customers, Digital Wholesale Banks like ANEXT and GLDB can only target non-retail segments i.e. providing banking services that cater to the monetary needs of small and medium-sized enterprises (SMEs).

And this is where OxPay and GLDB can collaborate in a win-win partnership.

OxPay and GLDB’s Partnership

In a press release dated 21 December 2023, OxPay announced a Memorandum of Understanding (MOU) with GLDB, aimed at exploring opportunities in merchant acquisition, with both companies leveraging their strengths to achieve mutual business expansion goals.

Under the terms of the MOU, OxPay’s subsidiary, OxPay SG Pte. Ltd., will actively promote GLDB’s banking and financing facilities within its growing merchant network.

In return, GLDB will be sharing OxPay’s cutting-edge payment solutions to its existing customer base – potentially increasing the base of prospective merchants and business entities for OxPay.

This strategic move underscores OxPay’s dedication to creating synergies within the financial technology sector, bringing together payment solutions and digital banking services for the benefit of clients and merchants.

Mr Yick Li Tsin, Chief Operating Officer of OxPay SG, commented,

“By combining OxPay’s robust payment solutions with GLDB’s specialised banking services, we are setting a new standard for integrated financial services. Our collaboration is not just about business growth, but also aims to create synergies to drive significant value for our customers and the market.”

Mr Gary Wu, Chief Marketing Officer of GLDB, added,

“As a digital bank, our financial services are naturally readily accessible. However, we have also ensured that we make it simpler, safer, and more rewarding for SMEs to obtain financial services from our collaboration with OxPay.”

Benefits from Growing ASEAN Payments Industry

The collaboration between OxPay and GLDB comes at a pivotal time for the ASEAN payments industry.

According to a report by Google, Temasek, and Bain & Company, the Asean payments industry is expected to reach US$1.3 trillion by 2025. The report also forecasts that digital payments will account for 40% of total payments in Southeast Asia by 2025, up from 10% in 2020, driven by the rapid adoption of e-commerce, online travel, and ride-hailing services, as well as the increasing penetration of smartphones and internet access.

With that in mind, the ASEAN market presents immense potential for companies operating in the payments and banking sectors. The integration of OxPay’s payment solutions with GLDB’s digital banking services bodes well for OxPay to capitalize on the burgeoning opportunities within the region.

OxPay’s Insider Ownership Emits Confidence

Another positive sign for OxPay’s investors is the high level of insider ownership and buying activity.

Chairman Mr. Ching Chiat Kwong – who is also CEO of Oxley Holdings – owns 27.8% of the company’s shares, indicating a strong alignment of interests with shareholders.

In addition, according to the latest filings, Mr. Ching has been actively buying more shares in the open market over the past year. This shows that Mr. Ching is confident and optimistic about the company’s prospects and performance, as well as his commitment to creating long-term value for shareholders.

Conclusion

In conclusion, OxPay Financial Limited’s collaboration with Green Link Digital Bank marks a strategic confluence of payment solutions and digital banking services.

Investors may find this collaboration promising, considering the potential for increased revenue streams, expansion of market share, and a strengthened position in the competitive financial technology landscape.

As featured on The Edge

Earnings of Enviro-Hub Holdings came in at $0.7 million in 1HFY21 ended June, a reversal from the losses of $1.6 million logged in the year before.

On a fully diluted basis, this translates to earnings per share of 0.042 cents, compared to losses per share of 0.154 cents in 1HFY20.

With this, net asset value per share was 4.24 cents as at June 30, versus 4.50 cents on Dec 31.

Revenue for the first six months of the year was up 19.6% y-o-y to $17.7 million, thanks to a 78.8% jump in revenue from its e-waste recycling segment.

As featured on Khmer Times

Hong Lai Huat has been farming in Cambodia since 2008. The Singapore company got off to a rocky start, because its original crop was corn, which is labour-intensive and dependent on the right weather. It switched to cassava in 2013 because it is more resilient than maize – and saw profits take off.

Aoral Farm is now one of the largest privately owned cassava plantations and starch factories in the Kingdom. It occupies 10,000 hectares of land in Kampong Speu province. Sold under the CAMFARM brand, the farm supplies as much as 100,000 tonnes of cassava starch, also known as tapioca, a year.

The Coronavirus pandemic made Hong Lai Huat realise the importance of food security so it decided to sell off its Singapore Farm Resort, which was mainly focused on hotels, restaurants and beer gardens, and use the money to turn Aoral Farm into a mixed-use agricultural hub one seventh the size of Singapore.

As featured on The Business Times

THE proposed sale process of mm2 Asia MM2 Asia: 1B0 +4.84%‘s cinema business will run in parallel with its runway toward listing it on the Singapore Exchange’s Catalist board, the company said on Tuesday.

In a bourse filing, the company said that notwithstanding the pending offer for 80 per cent of the business, called mm2 Connect, from local investor Kingsmead Properties pegged at a range of S$80 million to S$120 million, its proposed initial public offering (IPO) continues and will proceed if market conditions are favourable and shareholders approve the plan.

In other words, if Kingsmead is unable to complete its acquisition ahead of mm2 Connect’s IPO, the transaction will not proceed, the entertainment firm said. Instead, as previously announced, Kingsmead will have the option of using the S$3 million in deposit it has paid to mm2 Asia so far to purchase shares in mm2 Connect at a discount to the cinema IPO price.

Both transactions will require the approval of mm2 Asia’s shareholders, its board added.

Enviro Healthcare, a wholly-owned unit of Enviro-Hub Holdings, has entered a sale-and-purchase agreement for its planned acquisition of the remaining 75 per cent stake in an associate, Pastel Glove, for S$46.8 million.

The mainboard-listed company previously disclosed on May 21 that it would pay S$23.4 million in cash for Pastel Glove, and issue 292,500,000 new shares at S$0.08 apiece. There will be a one-year moratorium for the shares.

Enviro-Hub: Update on Pastel Glove

As featured in Dollars & Sense

Singapore is internationally recognized as one of the world’s top maritime ports, accorded as the world’s Top Maritime Centre for 8 consecutive years by the Xinhua-Baltic International Shipping Centre Development (ISDC) Index and the world’s Top Leading Maritime Capital Of The World for 4 consecutive years by Menon Economic’s Leading Maritime Capitals Of the World report. With such accolades, Singapore is home to many marine and shipping companies. While most Singaporeans are familiar with Sembcorp Marine and Keppel O&M, Singapore is also host to many smaller players in the marine industry that all play a part in our bustling port.

One of these marine companies is Marco Polo Marine (SGX: 5LY) which has been listed on the SGX Mainboard since 2007. Macro Polo Marine operates regionally, with a significant presence in Indonesia. The company focuses on integrated marine logistics and engages mainly in shipping and shipyard operations. Their shipping operations involve the chartering of Offshore Supply Vessels (OSV) for deployment in regional waters and the chartering of tug boats and barges. As of 1HFY2021, they have 11 OSVs and 2 Maintenance Work Vessels (MWVs) in operation. For shipyard operations, the company has a shipyard located in Batam, Indonesia that can undertake projects involving mid-sized and sophisticated vessels.

In June 2021, the company also announced its plans to extend their dry dock 1 which would increase its capacity for ship repairs by 20%. This is scheduled to complete by January 2022 and expected to contribute to the bottom line from 2QFY2022. The company also announced in May 2021 their plan to increased their stake in one of their Indonesia listed entity – PT BBR to 72%. This would increase Macro Polo’s presence in Indonesia.

Aside from expanding their ship repairs capacity where they seen growth in recurrent customers and their main focus on shipping and shipyard activities, Macro Polo is also diversifying to renewables by leveraging their existing capabilities to enter into the sustainables sectors. This includes securing contracts to construct 2 smart fish farms as well as deploying vessels to work on windfarm projects.

For those interested to find out more about the marine industry or interested to invest in marine companies, here are 5 things to know about Macro Polo’s business.