My Cart 0

My Cart 0

BROKER’S REPORT

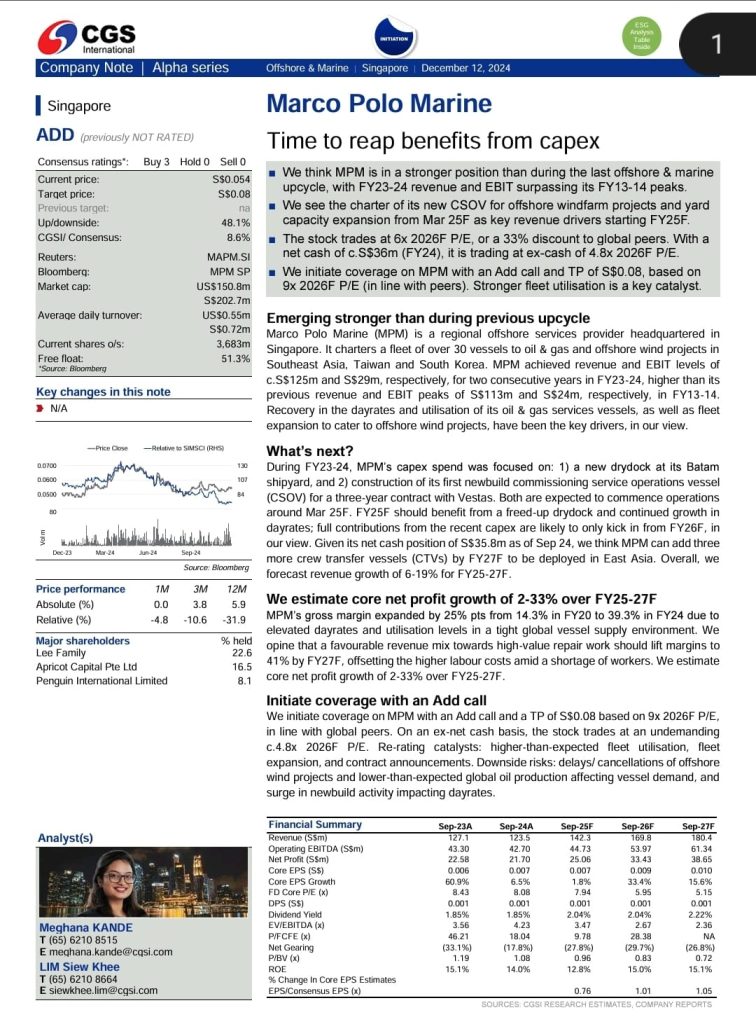

CGS Research INITIATION on MARCO POLO MARINE (SGX: 5LY)

CGS initiates coverage on MPM with an Add call and TP of S$0.08, based on

9x 2026F P/E (in line with peers). Stronger fleet utilisation is a key catalyst.

📈Time to reap benefits from capex

MPM is in a stronger position than during the last offshore & marine

upcycle, with FY23-24 revenue and EBIT surpassing its FY13-14 peaks.

The charter of its new CSOV for offshore windfarm projects and yard

capacity expansion from Mar 25F as key revenue drivers starting FY25F.

The stock trades at 6x 2026F P/E, or a 33% discount to global peers. With a

net cash of c.S$36m (FY24), it is trading at ex-cash of 4.8x 2026F P/E.

- 1Q2020 revenue rose by 15.5% to RM135.6 million on the back of revenue contributions mainly attributable to its newly acquired Brand Connect Group

- Robust cash and cash equivalents position of RM273.3 million

- XMI Group Pte Ltd’s Over The Top (“OTT”) Streaming platform is an alternative for content and music with gamified elements, providing an immersive experience for users

- Gateway to introduce Vividthree’s Virtual Reality (“VR”) production via the OTT Streaming platform

- Vividthree to subscribe up to S$1.5 million Convertible Notes in XMI

- Synagie to offer first-of-its-kind, one-stop business solution to help SMEs grow their online cross-border business and fulfil cross-border orders to consumers in China

- Increase Group’s presence in Central Singapore

- Number of endoscopy centres expanded to 10

- Onboarding of 3 veteran GPs with more than 40 years of experience in primary healthcare, and a stable pool of patients for referrals

- Expands GP network footprint to central Singapore, within close proximity to prime residential districts and private hospitals

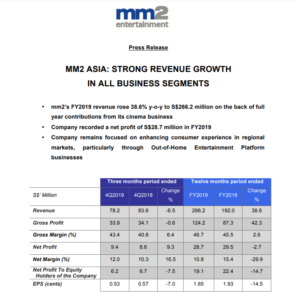

- mm2’s FY2019 revenue rose 38.6% y-o-y to S$266.2 million on the back of full year contributions from its cinema business

- Company recorded a net profit of S$28.7 million in FY2019

- Company remains focused on enhancing consumer experience in regional markets, particularly through Out-of-Home Entertainment Platform businesses

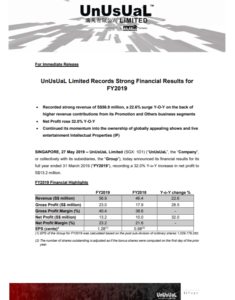

- Recorded strong revenue of S$56.9 million, a 22.6% surge Y-O-Y on the back of higher revenue contributions from its Promotion and Others business segments

- Net Profit rose 32.0% Y-O-Y

- Continued its momentum into the ownership of globally appealing shows and live entertainment Intellectual Properties (IP)

- Recorded 4Q2019 Revenue rose 121.6% y-o-y to S$4.0 million

- Net Profit surged more than twentyfold to S$1.5 million in 4Q2019

- Gross Profit margin jumped by 29.9% to 68.6% in 4Q2019 due to better margin yielded by its Content Production segment

- Train To Busan Virtual Reality (“TTB VR”) tour show extends to another province in China, Xiamen, with 1-year exclusive territorial rights granted to the local promoter

- Synagie to collaborate with Singapore Post to provide cloud-based warehousing and fulfilment solutions

- Collaboration will enable small and medium-sized enterprises to utilise state-of-the art warehousing services in Singapore and Southeast Asia

Duty Free International Limited Reports 1Q2020 Performance

SGX Mainboard listed Duty Free International Limited (SGX:5SO) (“DFI”, the “Company”, or collectively with its subsidiaries, the “Group”), the largest multi-channel duty free and duty paid retail group in Malaysia with strategic locations across Peninsular Malaysia, today announced its financial results for its three months ended 31 May 2019 (“1Q2020”), recording a 15.5% Y-o-Y increase in revenue to RM135.6 million and net profit stood at RM7.8 million.

Given the present economic outlook and increasingly competitive business environment as well as cautious consumer spending, the Group’s business performance is expected to remain soft and challenging due to macroeconomic trends such as slower global growth. The Group will continue its efforts in optimising operational efficiency and effectiveness by close monitoring of the key cost drivers and improving its core business in order to remain resilient in the retail industry.

Vividthree Holdings Amplifies Growth with an Investment in Award-Winning Technology Pioneer XMI Group

Vividthree Holdings Ltd. (SGX: OMK), a virtual reality, visual effects and computer generated imagery production studio (“Vividthree”, the “Company” or the “Group”) today announced its subscription of up to S$1.5 million Convertible Notes in XMI Group Pte Ltd (“XMI”) (the “Vendor”), which can be converted into shares in the capital of XMI.

Through Vividthree’s investment into this content streaming company – XMI, it is envisioned that XMI’s OTT Streaming platform will encourage the rise of VR entertainment at home, allowing Vividthree to consolidate its long-term interest in aggregating and distributing high-quality VR content to consumers worldwide.

The investment is likely to prepare the Group for the arrival of 5G network, as it leverages on this technology breakthrough to create Nextertainment (Next Generation of Entertainment) – fresh experiences in media consumption that allow consumers real time interaction with high quality immersive media with no latency, anywhere and anytime.

Managing Director of Vividthree, Mr Charles Yeo commented, “The investment in XMI is in line with our growth plans and has strategically placed ourselves in a better position to expand our business at a faster pace and fortify our presence in the technology sector. As a regional forerunner of content creation in immersive media, we want to create Nextertainment with the arrival of the upcoming 5G network. We will continue to fuel our growth with organic and inorganic strategies as we explore further synergies with potential technology and media-related companies.”

Synagie Inks Deal with China’s Largest Wechat Solutions Provider to help SMEs in Southeast Asia penetrate China’s behemoth Social e-commerce Market

Synagie Corporation Ltd. (SGX: V2Y) (“Synagie”, “思腾控股有限公司”, the “Company”, or the “Group”), Southeast Asia’s leading e-commerce enabler that assists brands to execute their e-commerce strategies using its cloud-based platform, is delighted to announce that it has signed an agreement with a wholly-owned subsidiary of Hong Kong Main Board listed Weimob Inc (HKG: 2013) (“Weimob”) to offer its integrated crossborder e-commerce and advertising solutions that will help SMEs in Southeast Asia (“SE Asia”) penetrate China’s behemoth social e-commerce market.

Weimob is China’s leading cloud-based commerce and marketing solutions provider and also the largest third-party service provider for SMEs in the WeChat ecosystem, which has more than 1 billion monthly active users. It offers advertising solutions that covers the entire Tencent ecosystem, Baidu and Q&A platform – Zhihu to help merchants drive traffic.

Through this agreement, Synagie will leverage on Weimob’s e-commerce enablement solutions and deep domain expertise in the China e-commerce market to offer an end-to-end solution via Synagie’s cloud commerce platform that will allow SMEs in Singapore and SE Asia to penetrate China’s social e-commerce market. Synagie’s end-to-end solution will cover the entire commerce value chain from setting up SMEs’ WeChat official account to digital store management, content translation, digital marketing and smart supply chain for fulfilling crossborder orders to consumers in China.

CEO & Executive Director of Synagie, Mr Clement Lee commented, “No more worrying about logistics, warehousing or how to engage new customers in different countries. All a SME needs is an internet browser to manage and grow their multi-channel or cross-border online business in Southeast Asia and China. We believe this is the future of commerce and one that is well suited for SMEs as no upfront investment is required. We are looking at a “new partnership model” with our customers where we will take a percentage of sales when we help them sell.”

New Endoscopy Centre by HC Surgical Specialists With the Incorporation of New Subsidiary – HC (Ming) at Camden Medical Centre

Catalist-listed HC Surgical Specialists Limited (SGX:1B1) (“HCSS”, or collectively with its subsidiaries and associated companies, the “Group” or the “Company”) today announced that it has, together with Medistar Services Pte. Ltd. (“Medistar”), incorporated a subsidiary in Singapore known as HC (Ming) Pte. Ltd. (“HC Ming”) for the provision of medical services.

HC Ming was incorporated on 6 June 2019 in the Republic of Singapore, with HCSS and Medistar holding 80.0% and 20.0% of the total issued share capital in HC Ming respectively. HC Ming will set up an endoscopy centre within The Ming Clinic, bringing the Group’s network of endoscopy centres to ten and further enhancing HCSS’s presence in central Singapore.

Chief Executive Officer of HCSS, Dr. Heah Sieu Min commented, “We are privileged to partner with Medistar, our future associated company. Our new endoscopy clinic will be strategically situated within The Ming Clinic, allowing us to tap on the clinic’s ready pool of patients. The strategic positioning of the clinic, which is located within Camden Medical Centre, a private medical centre that houses over 150 doctors, may also provide a vast consortium of patient referrals for the Group. Through our strategic incorporation of HC Ming, we look forward to providing a wider range of quality medical services with more options made available to all in the heart of Singapore.”

HC Surgical expands GP network with Medistar Services Pte. Ltd

Catalist-listed HC Surgical Specialists Limited (SGX:1B1) (“HCSS”, or collectively with its subsidiaries and associated companies, the “Group” or the “Company”) today announced that it has entered into a Sale and Purchase Agreement (“SPA”) with Dr. Tan Hooi Hwa (“Dr. Tan”), Dr. Pang Heng Mun Roger (“Dr. Pang”) and Dr. Wong Yik Mun (“Dr. Wong”) (collectively the “GPs” or “Vendors”), to acquire a total of 25.0% of the total issued and paid-up share capital of Medistar Services Pte. Ltd. (“Medistar”) for a total purchase consideration of S$480,000 (“Purchase Consideration”) (the “Proposed Acquisition”). Dr. Lai Junxu, a general practitioner with the Group, will acquire 5.0% of the total issued and paid-up share capital in Medistar.

The addition of the GPs will strengthen the Group’s capabilities and is in line with its plan for growth and expanding its presence in Singapore as HCSS’s team of GPs will increase from five to eight.

Chief Executive Officer of HCSS, Dr. Heah Sieu Min said: “The Proposed Acquisition of Medistar is in line with our strategy of business expansion by acquiring GPs to secure a consistent stream of patients through GP referrals. Dr. Tan, Dr. Pang and Dr. Wong are industry veterans with a stable pool of patients, and we are very excited for them to join our HCSS family. The strategic location of The Ming Clinic, which is in near proximity to Singapore’s prime residential districts and the neighborhood of private hospitals such as Gleneagles and Mount Elizabeth Hospital, will further expand our GP network to the heart of Singapore.”

MM2 ASIA: STRONG REVENUE GROWTH IN ALL BUSINESS SEGMENTS

mm2 Asia Ltd. (“mm2 Asia”, “mm2 全亚影视娱乐有限公司” or collectively with its subsidiaries, the “Group”), today announced its financial results for the full year ended 31 March 2019 (“FY2019”).

Chief Executive Officer of mm2 Asia, Mr. Chang Long Jong (章能容), commented on the Group’s results, “FY2019 performance was a collaborative effort delivered by the Group. We saw, for the first time, the full year contribution from our Singapore cinema operations, and the results are encouraging. On the other hand, our content production, post production, and event production and concert promotion businesses have all made inroads in North Asia. We continue to see operational synergies across our business segments, which we look to capitalize on going forward.”

Executive Chairman of mm2 Asia, Mr. Melvin Ang ( 洪伟才) , annotated, “Amidst the global economic uncertainties and heightened market risks, we remain optimistic in our pipeline of regional projects, which include a slate of feature films, concerts, and family entertainment shows. Simultaneously, we are looking to strengthen our value proposition as one of the leading content creators in Asia, with an increasing focus on our Out-of-Home Entertainment platforms, led by UnUsUaL, Vividthree and mm2 Asia’s cinema business, to collectively enhance our consumer experience across regional markets.”

Mr. Ang added, “Enhancing shareholder value has always been a key focus for us. We are actively exploring different avenues to maximise shareholder value, including the possibility of seeking a foreign listing of our cinema business.”

UnUsUaL Limited Records Strong Financial Results for

FY2019

UnUsUaL Limited (SGX: 1D1) (“UnUsUaL”, the “Company”, or collectively with its subsidiaries, the “Group”), today announced its financial results for its full year ended 31 March 2019 (“FY2019”), recording a 32.0% Y-o-Y increase in net profit to S$13.2 million.

The local and regional live entertainment industries remain competitive and challenging. In this regard, we have established our plans for the next 12 months, which include the Promotion and Production of globally appealing shows in addition to our usual offerings of concerts by well-known artistes. With this, we look towards a reasonable performance ahead.

Annotating on the Group’s FY2019 results, Chief Executive Officer of UnUsUaL, Mr Leslie Ong said, “It has been an exhilarating year with many critical opportunities that opened doors for us. Looking back at our achievement in the past one year, we are especially gratified with how far we have come today as a Group. The Group’s financial performance in FY2019 is a testament to our hard work and a reflective indication of our capabilities as one of the leading names in Asia in the industry. As we keep our momentum and chart further growth ahead, we will continue to improve operations and strengthen our business with better entertainment products that can excite and grow our audience and boost our target audience beyond the traditional concert goers.”

Vividthree Holdings Reports Positive Growth in 4Q2019

Vividthree Holdings Ltd. (SGX: OMK), a virtual reality, visual effects and computer-generated imagery production studio (“Vividthree”, the “Company” or the “Group”) today announced its financial results for its three months ended 31 March 2019 (“4Q2019”) and full year ended 31 March 2019 (“FY2019”).

Looking ahead, the Group remains focused on strengthening their presence in Asia as a digital content producer. Following the completion of its flagship TTB VR tour show in Beijing, the tour show will subsequently travel to another province in China, Xiamen, where the Group has engaged a local promoter by granting them a 1-year exclusive territorial rights to host the tour show in the particular province. The Group will also be tapping on the worldwide success of the Korean blockbuster, TTB, which will soon have a sequel slated for release in 2020. As a result, the Group has received warm responses from several promoters in the region, and it is currently in negotiations to take the TTB VR tour show to other parts of the world.

Managing Director of Vividthree, Mr Charles Yeo commented, “This set of results marked a good finale to the fiscal year 2019. We are just at the beginning, the tip of the iceberg. As we gained positive traction in our Content Production business, particularly the Train To Busan Virtual Reality tour show, we are proud to unravel it to more vibrant provinces in China, such as Xiamen while exploring more opportunities across the globe. We will keep up our continued momentum in actively seeking more evergreen intellectual property products and constantly aim to maximise shareholders’ returns in the longer term.”

Riding on the fast-growing experience economy, the Group is also looking into the use of VR technology to improve the experience of an escape game (a room filled with puzzles and scenario games), which has become a worldwide craze in recent years. The Group will continue to look for merger and acquisition opportunities, as well as new intellectual property products to expand its Post-Production and Content Production businesses.

SingPost & Synagie partner to provide on-demand

warehousing and logistics solutions for SMEs in

Singapore and Southeast Asia

Southeast Asia’s small and medium-sized enterprises (SMEs) will now be able to utilise stateof-the-art warehousing and fulfilment services provided by SingPost subsidiary Quantium Solutions, and powered by Synagie’s cloud commerce platform. The partnership will enable SMEs to capitalise on the strong growth in eCommerce order volumes while enjoying the same enterprise grade logistics capabilities used by industry leaders. It also offers SMEs a one-stop solution for greater operational efficiency and faster turnaround times in both the traditional and eCommerce markets.

SingPost’s partnership with Synagie to provide on-demand warehousing allows brands and SMEs to save on the heavy upfront capital expenditure required to set up or operate their own warehouse, as they are able to acquire integrated warehousing services on a pay-as-you-use basis without long-term commitments. This highly scalable solution will better help them cater to the spikes in warehousing demands during peak seasons (such as mega sales events) and provide greater cost savings and better inventory management.

Commenting on the partnership, Synagie’s Executive Director and CEO, Clement Lee said: “We are honoured to collaborate with SingPost to provide one of the region’s first fully integrated on-demand warehousing and fulfilment solution focused at helping SMEs manage their multi-channel supply chains. By combining our solutions and infrastructure, we can provide a fulfilment ecosystem for brands and SMEs that will bring about greater efficiencies and cost savings for both their offline and online businesses.”