My Cart 0

My Cart 0

Date: 24 February 2025

Overview

On 21 Feb 2025, the Monetary Authority of Singapore (MAS) announced a S$5b investment initiative aimed at boosting liquidity for Singapore’s capital market. This initiative is expected to benefit small and mid-cap stocks, particularly those listed on the Singapore Exchange (SGX).

Top Small/Mid Cap Picks

| Company | Recommendation | Share Price (S$) | Target Price (S$) | Upside (%) |

|---|---|---|---|---|

| ComfortDelGro | BUY | 1.36 | 1.77 | 30.1 |

| CSE Global | BUY | 0.45 | 0.59 | 31.1 |

| China Sunsine | BUY | 0.48 | 0.58 | 20.8 |

| Centurion | BUY | 1.02 | 1.11 | 8.8 |

| Digital Core REIT | BUY | 0.57 | 0.88 | 54.4 |

| Marco Polo Marine | BUY | 0.05 | 0.072 | 41.2 |

| Propnex | BUY | 1.13 | 1.18 | 4.4 |

| Riverstone | BUY | 1.00 | 1.16 | 16.0 |

| Singapore Post | BUY | 0.56 | 0.72 | 29.7 |

| Valuetronics | BUY | 0.65 | 0.78 | 20.0 |

Analysis

The MAS investment initiative is designed to enhance market liquidity and is expected to significantly benefit small and mid-cap stocks. The focus on actively managed strategies rather than index-focused investments will help diversify investments and bring attention to undervalued stocks with strong growth potential.

Valuation Overview

Key metrics such as P/E ratios, P/B ratios, and dividend yields were considered in selecting the top stock picks. This approach ensures that the selected stocks not only have strong growth potential but also offer attractive valuations and returns to investors.

BROKER’S REPORT

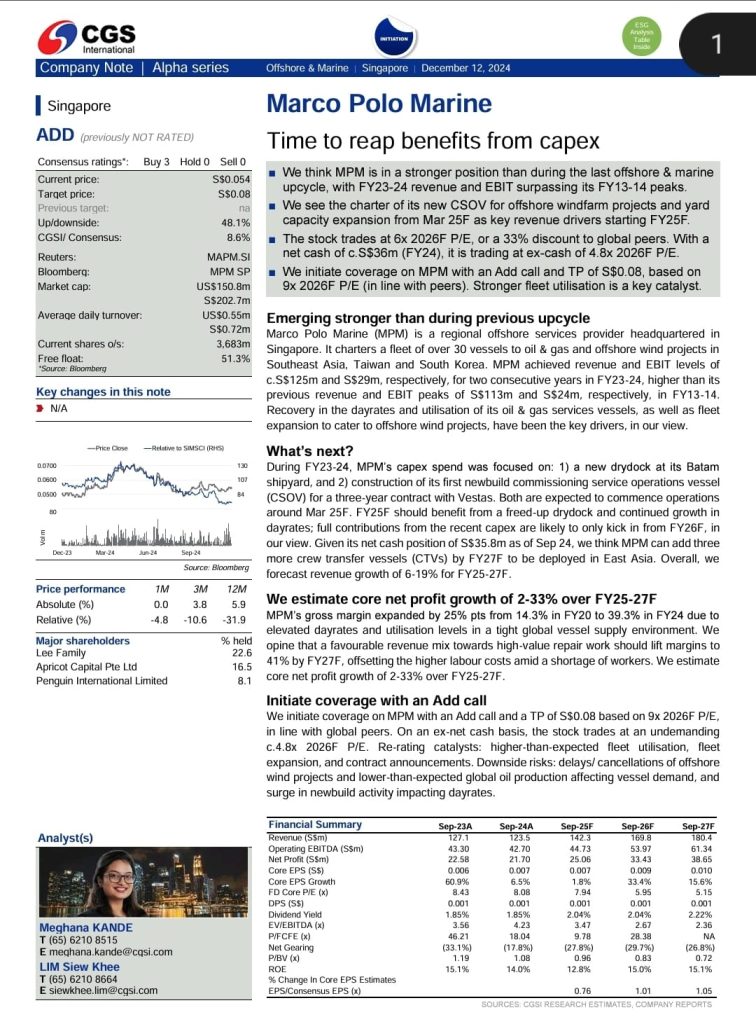

CGS Research INITIATION on MARCO POLO MARINE (SGX: 5LY)

CGS initiates coverage on MPM with an Add call and TP of S$0.08, based on

9x 2026F P/E (in line with peers). Stronger fleet utilisation is a key catalyst.

📈Time to reap benefits from capex

MPM is in a stronger position than during the last offshore & marine

upcycle, with FY23-24 revenue and EBIT surpassing its FY13-14 peaks.

The charter of its new CSOV for offshore windfarm projects and yard

capacity expansion from Mar 25F as key revenue drivers starting FY25F.

The stock trades at 6x 2026F P/E, or a 33% discount to global peers. With a

net cash of c.S$36m (FY24), it is trading at ex-cash of 4.8x 2026F P/E.

- Mr. Royston Tan – Head of Research, GEM COMM

- Mr. Sean Lee Yun Feng – Chief Executive Officer, Marco Polo Marine

- Mr. Bryan Kee Boo Chye – CEO, Chairman, and Executive Director, Sheffield Green

- Mr. Paul Whiley – Chief Operating Officer and Executive Director, Mermaid Maritime

- Surge in margins and profitability

- Larger orders likely with higher margins

- Remains One of our Top SMID Picks

- Headquartered in Singapore, Sheffield Green is a human resource (HR) services provider for the renewable energy industry. Aside from Singapore, the Group has subsidiaries in Japan, Poland, and a branch office in Taiwan and South Korea. Sheffield Green specialises in supporting EPCI (Engineering, Procurement, Construction and Installation) works within the renewable energy industry, including onshore and offshore wind, solar and green hydrogen.

- Our HR solutions are segmented into:

- Provision of HR services: To supply a wide range of personnel per clients’ requirements ranging from management personnel (including C-suites) to technical personnel and offshore crew personnel across industry sub-segments.

- Ancillary Services: Providing end-to-end ancillary services including visa and work permit applications, training and deployment logistics. A new initiative is the recent establishment of a training centre in Taiwan to develop and train specialised workers for the renewable energy industry.

- According to the Global Wind Energy Council, wind energy is projected to furnish one-fifth of the world’s electricity by 2030, and Precedence Research forecasts the offshore wind energy sector’s expansion from US$33 billion in 2023 to over US$179 billion by 2032. According to IRENA, this is likely to lead to a substantial expansion in the renewable energy industry, with job opportunities slated to increase from 13.7 million in 2022 to 38.2 million by 2030. We believe that we are well-positioned to capture this growth in the renewable energy industry through our comprehensive range of HR services.

- Furthermore, Sheffield Green is poised to broaden our services by exploring potential mergers and acquisitions, alongside strategic partnership opportunities with third-party service providers. This expansive range of offerings positions the Group as a one-stop solution for all renewable energy manpower needs.

- Given macro uncertainties and rising costs, some offshore wind projects have turned financially non-feasible. However, Sheffield Green believes that tenders within the industry remain robust.

- Poland is seeing a healthy level of offshore wind activity given favourable trends in this industry. We have established our Poland office in November 2023, and have onboarded two new clients in 1H2024. With a Poland-based operational manager in place, we look to further grow our business and onboard new clients. We also have a Business Development Manager stationed in Poland. Additionally, our Operations Director, Engel, rejoined the Group earlier this year to bolster the team in Poland. We anticipate a similar demand for skilled blue-collar workers in Poland as we are currently seeing in Taiwan.

- Taiwan has a target to generate 20% of the country’s electricity using renewable energy, with a focus on offshore wind. The total investment in this sector is projected to reach ~US$33 billion and is expected to generate roughly 20,000 new jobs. We have established a training centre in Chiayi County, Taiwan to train a skilled workforce to meet client demands and industry standards.

- South Korea aims to achieve 14.3 gigawatts (GW) of offshore wind capacity by 2030, driven by investments and strategic international partnerships. To capitalise on these trends, we have recently established an office in Seoul and hired a business development manager to spearhead our operations and grow the business.

- The HR requirements of this industry are very niche, requiring specialised knowledge and expertise to be able to fulfil staffing requirements, especially for EPCI needs. Given the relatively new secular growth in renewable energy HR needs, we believe that we are well-equipped with our HR offerings to capitalise on this specialised demand.

- The training centre was a new strategic initiative launched in 2024, designed to address the increasing need for skilled personnel in the burgeoning offshore wind sector. Three highly qualified Taiwanese instructors will be leading training programmes to craft a workforce, recognised and valued by clients, and ready to meet the immediate and complex needs of the offshore wind market.

- We believe that this is a win-win initiative that allows the Group to diversify our revenue streams by adding an education angle to our portfolio, while also ensuring that client requirements for well-trained personnel are met. We are considering expanding the number of training centres in Taiwan and in other operating regions, such as Poland.

- We are pleased to announce that our geographical expansion progress is on track, with the set-up of our office in Boston, USA on target in 2H24. The US has a strong outlook for its offshore wind sector and remains a target market for us. The recently approved Sunrise Wind offshore wind project in the US aims to power 320,000 homes and support 800 jobs.

- Our new office in Seoul, South Korea, is expected to attract new clients and expand our presence in the region over the next few months. Our new Business Development Manager, who recently joined the Seoul office, will also oversee the Japanese market with the support of our local country advisor in Tokyo. As a result, we anticipate an increase in business activities from this region over the next year.

- Sheffield Green provides HR services specific to the renewable energy industry. We have a seasoned recruitment team with the ability to source and procure a diverse array of specialised talent, to fulfil the manpower demands of renewable energy projects.

- Our niche expertise is highly valued by the industry as shown by our work with our clients. From a single client in Taiwan in 2018, Sheffield Green has strategically positioned itself as the go-to partner for major players in the region. This rapid expansion exemplifies our scalable model and ability to extend our offerings globally.

- Furthermore, our work has led to long-standing and valuable client relationships, underscoring our commitment to excellent service and customer satisfaction. Examples of esteemed clients include Boskalis, CSBC Corporation Taiwan, and Volstad Maritime. This is a strong indicator of Sheffield Green’s reliability, performance, and the consistent value we deliver to clients.

- ESG is a key concern for Sheffield Green. Two factors that are material to us are People and Carbon Footprint Management.

- At Sheffield Green, People is a core component of our business, given we provide HR services. As such, we place a huge importance on the welfare of our employees. This includes economic advancement, workplace safety, as well as fair and pleasant working conditions, etc.

- As an operator within the renewable energy industry, it is also critical for us to manage our carbon footprint. Hence, we strive to ensure our carbon footprint is measured and reported according to relevant regulatory standards. We have also committed to lowering our carbon footprint by replacing our existing energy source with low or zero-carbon sources as we transition to become a low-carbon organisation.

- We are focused on expanding our presence in Taiwan, Poland and South Korea, which include onboarding new clients and securing more contracts. Our first training centre in Taiwan is a significant milestone for us, and will set the precedence for more centres in the future. Poland has enjoyed positive momentum with the signing of new contracts in 1H24, and we believe that this region will see further momentum. South Korea is another exciting region for us, and we expect positive momentum in the form of new clients and contracts.

- The opening of our Boston office remains on track in 2H24, and we will provide updates accordingly. Although Japan has a promising outlook over the next 2-3 years, it remains a challenging market due to cultural differences. However, the Group remains committed to building its presence in Japan.

- Management believes that Sheffield Green is a pick-and-shovel play for investors seeking exposure to the burgeoning renewable energy industry. As a provider of HR-related and ancillary services specifically catering to the renewable energy industry, the Group has an asset-light business model with profit before tax margin reaching 17% for FY23, highlighting substantial profitability.

- With a net cash (less lease liabilities and borrowings) position of US$7.3 million as at 31 December 2023, management believes that Sheffield Green represents an opportunity for investors seeking exposure to the renewable energy industry.

- Subscribe now to the SGX My Gateway newsletter for a compilation of latest market news, sector performances, new product release updates, and research reports on SGX-listed companies.

- Stay up-to-date with our SGX Invest Telegram channel.

Raphael Lim

Fri, Oct 11, 2024 • 12:08 AM GMT+08 • 6 min read

Source: The Edge

Dyna-Mac is a global multi-disciplinary contractor specialising in engineering, procurement, fabrication, construction, and onshore pre-commissioning and commissioning of offshore topside modules and facilities.

1. What is Dyna-Mac’s business about and what are some key business divisions?

Dyna-Mac’s expertise encompasses FPSOs (floating production storage and offloading vessels), FSOs (floating storage and offloading vessels), FLNGs (floating liquefied natural gas vessels), and FSRUs (floating storage and regasification units). We excel in offshore topside module fabrication and construction, as well as onshore module fabrication for land-based plants in the hydrocarbons industry, with a focus on LNG, green and blue hydrogen, and ammonia.

2. Could you share some key drivers behind Dyna-Mac’s 3.8x y-o-y jump in 1H2024 net profit?

Dyna-Mac’s 3.8x y-o-y increase in net profit for 1H2024 stems from several factors. We successfully completed major projects, boosting revenue by 42.5% to $259.7 million. Our gross profit soared by 191.3% to $71.7 million, thanks to improved project execution and cost management.

Other income rose 116.3% to $7.6 million, driven by higher interest income, forex gains, and increased scrap income. Net profit reached $38.8 million, a 280.3% increase from 1H2023, due to project completions, enhanced productivity, and increased project volume. Our strong order book of $681.3 million as of June 2024 reflects sustained demand for our services, particularly FPSO topside modules.

3. Dyna-Mac has traditionally been based in Singapore, but it seems there are plans for international expansion. Can you share more about this?

Our expansion strategy is tailored to each region’s strengths and opportunities. In Singapore, we have delivered 17 modules weighing 41,000 metric tonnes with zero lost-time incidents in 1H2024, underpining our future-proofing strategy focused on sustainable growth through hydrogen and carbon capture projects.

In China, we offer value-added services by leveraging our expertise and collaborating with local partners to build modules, optimising costs and timelines.

Our Middle East focus remains on oil and gas, utilising the region’s excellent facilities and infrastructure for module fabrication, supported by skilled personnel from Singapore. This diversified approach positions us for sustainable growth and value creation across markets.

4. What is the competitive advantage of being a pure-play versus an integrated player in your industry, and who are your main competitors?

As a pure-play company, Dyna-Mac’s competitive advantages include specialisation, agility, transparency, and focused resource allocation. Our deep industry expertise allows us to deliver high-quality, innovative solutions. We can swiftly adapt to market changes and customer needs. Our focused approach offers clear performance visibility to stakeholders and enables efficient operations.

While we face competition from several Chinese firms in the offshore and marine engineering sector, our concentrated expertise in the hydrocarbons industry positions us uniquely. This specialisation, combined with our adaptability and efficiency, sets us apart in a competitive market.

5. Could you give an overview of the current industry trends? How is Dyna-Mac well-positioned to capture these?

Current industry trends include a focus on energy transition, digital transformation, sustainability and environmental, social and governance (ESG) considerations. Geopolitical factors and supply chain resilience are also key concerns, alongside innovations in materials and technologies. There is increased demand for natural gas as a transition fuel. Dyna-Mac is well-positioned to capture these trends through our expertise in low-carbon solutions, particularly in hydrogen and ammonia projects.

We leverage advanced engineering tools and digital technologies to enhance efficiency. Our strong order book and expanded fabrication capacity (up by 70%) enable us to meet increasing demand. Our commitment to high safety and environmental standards aligns with the industry’s growing ESG focus, positioning us favourably in this evolving landscape.

6. Tell us more about Dyna-Mac’s cost-plus pricing strategy.

Dyna-Mac adopts a cost-plus pricing strategy for certain projects. This method applies to some materials and involves charging the costs incurred plus an agreed-upon profit margin. This strategy not only guards against price volatility but also ensures transparency for our clients, aligning with best practices in financial management and managing client relationships.

7. Sustainability and ESG have increasingly been a key focus. How is your company committed to sustainability?

Dyna-Mac is deeply committed to sustainability across ESG domains. Our environmental initiatives include decarbonisation efforts, energy and carbon footprint management, and robust waste and effluents management. We prioritise employee health and safety and promote fair employment practices.

Our strong corporate governance ensures transparency and ethical business practices, as recognised by our recent Most Transparent Company Award (Energy) in September 2024 from the Securities Investors Association of Singapore (SIAS). We actively engage stakeholders and innovate in clean energy, venturing into green hydrogen and ammonia projects. Through strategic partnerships, we continually enhance our sustainable capabilities, balancing growth with environmental stewardship and social responsibility.

8. What are Dyna-Mac’s plans for capital allocation?

Dyna-Mac’s strategic capital allocation focuses on sustained growth and shareholder value. We are investing in yard development, expanding fabrication capacity by 70% to meet growing demand. We’re enhancing productivity through advanced technologies and equipment upgrades.

We are exploring M&A opportunities, particularly targeting companies offering recurring income streams like plant maintenance services. We maintain a healthy working capital position to ensure smooth operations. Additionally, we are committed to rewarding shareholders through dividends. This balanced approach supports our growth objectives, enhances operational efficiency and delivers value to shareholders.

9. Why should investors take a closer look at Dyna-Mac?

Dyna-Mac offers a compelling investment opportunity due to our solid financial performance in 1H2024. Our strong $307.7 million net cash position as of June 30 enables us to seize opportunities. We operate in the thriving FPSO market, with a robust $681.3 million order book extending through FY2026.

We are strategically diversifying into clean energy sectors like carbon capture and storage and hydrogen solutions. Our commitment to sustainability aligns with global trends towards cleaner energy. We leverage advanced technologies for enhanced project execution and efficiency, maintaining our competitive edge in the market.

10. In September, Dyna-Mac received a voluntary conditional offer of $0.60 per share from substantial shareholder Hanwha Group, which is seeking management control. What does this mean for investors?

The company has appointed an independent financial adviser (IFA) to assess the offer, and we are awaiting their guidance. At this point, it is important to note that the company continues to operate as usual. We encourage investors to stay informed through the official SGX announcements, where any updates or developments will be communicated transparently.

Frankie Ho

Thu, Oct 10, 2024 • 11:43 PM GMT+08 • 5 min read

Source: The Edge

Can SGX’s karaoke companies hit the right note?

A visual effects producer. An engineer trained in robotics and automation. A businessman who has dabbled in shipping and audio-visual equipment sales.

Despite their different backgrounds, all three share a common vision: to build their own empire in the music and entertainment industry. Their approach? Through karaoke.

The way they see it, karaoke has reclaimed its spot as a popular pastime for the masses after being pummeled to the brink of annihilation a few years ago by the pandemic. Investors, they reckon, should take heed of what it can offer now that it’s business as usual.

Flint Lu, founder and CEO of Goodwill Entertainment Holding, is the latest among the three to tout the trade. His company, which operates 11 karaoke outlets across Singapore, filed a draft prospectus on Sept 27 for a listing on the Catalist board of the Singapore Exchange SGX (SGX).

Before devoting all his energy to Goodwill Entertainment, which opened its first joint in 2015 and expects to have its 12th outlet sometime this quarter, Lu owned and ran a shipping company. He also sold China-made karaoke equipment in Singapore.

About a month before Goodwill Entertainment lodged its prospectus, Vividthree Holdings OMK announced a joint venture with local karaoke chain KStar to roll out automated karaoke lounges in Singapore. KStar, which has been in business since 2017, has four outlets of its own in the city-state.

The joint venture, 55%-owned by Vividthree, marks the computer animation specialist’s foray into the direct-to-consumer market, according to co-founder and CEO Charles Yeo, who has been creating visual effects for a living for over two decades. Vividthree’s first karaoke lounge with KStar is slated to open this quarter.

If Goodwill Entertainment’s IPO takes off, SGX will be home to three companies that have set their sights on making it big in the karaoke business. The other company besides Goodwill Entertainment and Vividthree is 9R.

Formerly known as Viking Offshore and Marine, 9R entered the karaoke trade in 2022 under the watch of Ong Swee Sin, a Malaysian engineer trained in robotics and automation. The company owns and operates nine karaoke outlets in Malaysia.

Business dynamics

How attractive is karaoke as a business? Should investors start paying attention to these three companies? How do these operators stack up against each other? With the pandemic over, are these firms in better shape now and ready for growth?

As the new kid on the block, Vividthree is the underdog among the three, even though it’s no stranger to the entertainment industry as it’s part of mm2 Asia 1B0, a well-known film and TV content producer and distributor.

Still, running a karaoke business is something Vividthree hasn’t done before. It will have to take its cue from its partner, KStar, even though it’s the larger shareholder in their 55:45 joint venture.

Apart from its marketing collateral, there’s not much public information on KStar, given that it’s a private company. However, since all four of its outlets are based in Singapore, some of the things disclosed in Goodwill Entertainment’s IPO prospectus, especially about industry dynamics and risk factors, would also apply to KStar to a certain degree. The more obvious of these include stiff competition, low entry barriers and notoriously fickle consumer palates.

Beyond opening more outlets and broadening their range of service offerings (Goodwill Entertainment, for example, is developing its own craft beers), setting up shop in other countries should also be a natural progression for the Vividthree-KStar joint venture and Goodwill Entertainment, given the small market in Singapore.

Goodwill Entertainment has already identified Malaysia as a market to get into. That, too, can be a new spot for the Vividthree-KStar joint venture, as Malaysia was Vividthree’s second-largest market by revenue for its core business in its last financial year.

9R expanded its reach in Malaysia quite significantly within just a couple of years. From a single outlet in 2022, it now runs a total of nine, the latest of which is at The Exchange TRX, a key development of the Tun Razak Exchange, the country’s first dedicated international financial district.

Gangbuster results? Unlikely

In terms of financials, all three companies are unlikely to deliver gangbuster results any time soon.

9R, in the red for the last two years, incurred a net loss of about $0.6 million for the first six months of 2024. Revenue for the first half amounted to $5.3 million.

Vividthree has been losing money for the last five years, during which revenue had not grown much except in the most recent year, when it started recognizing contributions from its newly acquired public relations business.

Goodwill Entertainment was profitable in 2022, 2023 and the first three months of 2024, with earnings of $1.1 million, $2.9 million and $0.4 million respectively. However, it expects compliance costs and IPO expenses to dent its overall bottom line for this year.

From the looks of it, karaoke’s allure will likely stay where it has always been — with singing enthusiasts. As far as investors are concerned, it just doesn’t seem to be something to crow about for now.

The writer is a former financial journalist and runs an investor relations consulting practice. He is also a part-time business journalism lecturer at a Singapore university. All views expressed are solely his.

Khairani Afifi Noordin & Nicole Lim

Thu, Oct 10, 2024 • 08:10 PM GMT+08 • 8 min read

Source: The Edge

Karaoke chain operator Goodwill Entertainment to list on SGX Catalist

Entertainment company and karaoke chain operator Goodwill Entertainment has filed its preliminary offer document in anticipation of listing on the Catalist board of the Singapore Exchange SGX (SGX) on Sept 27. The company is slated to complete the registration of its offer document on Oct 25, when there will be more information about its offer price and market capitalisation.

Goodwill Entertainment operates 12 “multi-entertainment” concepts across Singapore, including karaoke facilities, performance halls and dance clubs.

The news of Goodwill’s listing on the Catalist comes after 10 months of negligible listing activity, as Singapore re-energises its moribund stock market.

Only one company — the Singapore Institute of Advanced Medicine Holding — has listed on the Mainboard this year, while another — Food Innovator Holdings — has recently announced its intention to list on the Catalist. Two others that have lodged their prospectuses have withdrawn their application: LYC Medicare Singapore and A Wellness Holdings.

Goodwill’s founder and CEO Flint Lu established the karaoke chain “HaveFun Family Karaoke” in 2015. Born in mainland China, Lu has spent the past two decades in Singapore and has gained citizenship. The former contestant on The Voice of China, a popular television singing competition, brought the show to Singapore in the same year the company was founded.

Lu also used to own freight forwarding company Twinstar Logistics, before fully divesting his shares last year.

Now, Goodwill is ready for its next stage of expansion, which led to the decision to list on the Catalist. Lu tells The Edge Singapore that the Catalist listing requirements are more flexible, which allows for younger companies like his to raise capital and attract investment. This will help to grow and build its reputation as a leading entertainment company in Singapore and beyond.

Although Lu acknowledges that there are other more active bourses in the region, being listed on the SGX would be better for the company given Singapore is its home base. Goodwill has a strong brand presence in the city-state, and a local listing would give the company visibility among investors who understand the nuances of the country’s entertainment sector.

Upon a successful IPO, Goodwill will be the first company listed on the SGX with a primary business in running a karaoke chain, unlike 9R and Vividthree that run other primary businesses. This may be a double-edged sword — although Goodwill may gain a first-mover advantage, there is a risk that investors may not be able to fairly value the company and grasp its growth potential.

Lu highlights that Goodwill has proven it can be more than just a karaoke chain operator. For instance, during the “circuit breaker” period in 2020 when interactions in public and private places were restricted, the company had to pivot into new businesses including F&B distribution.

Today, the company has expanded its F&B offerings under its “Sticks N Stones” brand, integrating it into its entertainment venues.

“Our foundation lies in our karaoke outlets, but we have successfully expanded into other business verticals. With an evolving vision, we continuously study and learn from successful companies and entrepreneurs to keep innovating and improving,” Lu adds.

Surviving Covid-19

Currently, Goodwill derives the majority of its revenue from its karaoke outlets located islandwide. Each outlet provides its customers with a variety of amenities, from private cinemas to pool tables, dart machines, as well as board and console games. As part of its multi-entertainment strategy, some of its karaoke outlets have performance halls that serve as an event space for live band performances and meet-and-greet events, among others.

The company’s flagship outlet at Cineleisure Orchard also features its first dance club dubbed FATEbyhavefun, which provides its customers with a full “night-out” experience, Lu explains.

Goodwill has also newly launched a multi-entertainment concept “HaveFun Live Show”, a mega live entertainment house established with its partner Hezhong Entertainment Culture co.

While Lu does not elaborate on the profit margins of running the karaoke business, the company is recording stable financial results, having recovered from the pandemic when its business suffered greatly.

During those years, Goodwill did not let go of any of its staff members, and pivoted to renting out all-in-one karaoke machines that were delivered to homes and hotel rooms. Its F&B business, which was introduced then to generate extra revenue streams during the lockdown, helped to ease financial pressures.

When restrictions slightly eased, Goodwill started offering private movie screening sessions in its karaoke rooms, catering to small groups of customers. This, together with lease re-negotiations, allowed the company to stay afloat. In FY2021 ended December, Goodwill’s revenue stood at $930,000.

Business bounces back

As operations ramped up following further economic reopening, the company managed to post a turnaround story, with revenue surging $16.5 million in FY2022. The following year, revenue grew to $23.9 million — this translates to a CAGR of about 366% over the three-year period.

Net profit similarly grew, from a loss of $3.4 million to a profit of $3.2 million in FY2023. This follows pent-up demand for entertainment services, as customers returned to Goodwill’s karaoke outlets and live show venues. As of Dec 31, 2023, Goodwill’s liabilities stood at $7 million, while net operating cash inflow stood at $7.8 million.

Lu highlights that for 1HFY2024 ending June, Goodwill achieved $23.2 million in revenue, nearly equivalent to its full year revenue last year.

Goodwill’s most profitable locations differ every year, but the city outlets such as Bugis+ and Cineleisure Orchard always perform better than its outlets in the heartlands such as those in Toa Payoh and Pasir Ris, Lu says.

The low barriers to entry for new karaoke operators and ease of application for operating licences make the sector highly competitive. Despite this, Goodwill is still planning to open new outlets in Singapore. Lu believes that there is ample opportunity to further grow its business.

For one, compared to its competitors, Goodwill invests heavily in bringing in quality equipment, which it sources from China, where the karaoke sector has boomed. Additionally, the company also analyses the needs and wants of its Singaporean customers, customising its services to fulfill the local demand.

Vision for the future

From now until the registration of the offer document on Oct 25, Lu and his team will be busy convincing retail and institutional investors to take a shot at his karaoke company. Lu has already met a few prospective investors through the arrangements of the company’s sponsor and placement agent Evolve Capital Advisory and Haitong International Securities, receiving “very positive” feedback.

But the CEO is not losing sight of his bigger goal — to create a successful business to fulfil market demand, and use his resources and knowledge to help entrepreneurs expand into the Singapore market.

He reflects on past encounters with a pioneering entrepreneur in the Chinese F&B entertainment space, who has over 1,000 entertainment outlets in Nanjing City through the co-ownership of smaller brands. “The inspiration is not only how many outlets [the entrepreneur] managed to open in a single city, but the fact that he also trained and helped a lot of individuals to become business owners themselves,” says Lu.

For now, Lu sees potential in the F&B entertainment industry in Singapore and also Malaysia, given the cultural similarity. The company has set up an office in Malaysia, and is currently in the midst of discussions with venue owners in Kuala Lumpur and Genting Highlands. By 2025, Lu expects Goodwill to have a strong foothold in Malaysia and aims to enter additional Southeast Asian markets such as Indonesia, Thailand and Vietnam.

When asked about the most challenging part of running a business, he says: “Covid-19 could not get rid of us, so there’s no challenge bigger than that we cannot overcome.” Instead, a more important existential problem looms — Lu will need to align his employees to share the same vision as him.

Now, at this stage of growth, Lu’s team across the board needs to have a good understanding of his industry and sound judgement. Only with the right people will the company be able to grow to the next stage, he adds.

Ven Sreenivasan

Senior Columnist

Thu, Oct 10, 2024, 06:44 PM

Source: The Straits Times

Dyna-Mac rejects Hanwha’s takeover offer

SINGAPORE – The controlling estate of listed offshore and marine player Dyna-Mac has rejected the voluntary conditional offer by South Korean-controlled Hanwha Ocean, saying the 60 cents offer was a lowball price.

“Offer price of 60 cents per share was made when Dyna-Mac’s share price was at its lowest point over the previous 35 trading days,” stated a statement from the estate of Mr Lim Tze Jong, the late founder of the company.

“Dyna-Mac’s share price has consistently traded above the offer price since Hanwha’s announcement.”

The offer from Hanwha Ocean SG – a special-purpose vehicle controlled by Hanwha Ocean and Hanwha Aerospace – is conditional upon it ending up with more than 50 per cent of Dyna-Mac’s shares.

The South Korean entity owns nearly 282.9 million Dyna-Mac shares, representing 24 per cent of Dyna-Mac’s total number of shares, mostly purchased at around 40 cents in May from Keppel.

For its part, Dyna-Mac said the offer price needs to factor in the company’s strong financial performance and its current management team’s strategies for further growth.

In a statement, the company’s owners said the offer lacked an attractive control premium and is below analysts’ 12-month target price range of 64 to 71.5 cents. The stock closed at 63 cents on Oct 10.

The statement also noted that Hanwha’s expansion to offshore construction heightens Dyna-Mac’s synergistic value to Hanwha, given Dyna-Mac’s expertise in topside modules, and added that the offer price “needs to reflect value Dyna-Mac will bring to Hanwha’s global operations”.

It added: “At the current offer price for a Singapore gem, the estate does not find the offer by Hanwha compelling.”

A sharp uptick in offshore energy exploration projects has buoyed Dyna-Mac’s fortune of late, as it has the fortunes of other offshore and marine support and engineering players as well.

Dyna-Mac saw its net profit for the six months to June 30 surge 283.9 per cent to $38.8 million, on the back of a 42.5 per cent increase in revenue to $259.7 million following completions of major projects, improved productivity and a higher volume of projects undertaken. The company also had a net cash position of $307.7 million (including its holdings of Singapore Treasury Bills) as at June 30.

It remains to be seen if Hanwha will raise its offer price. The offer is conditional on the Competition and Consumer Commission of Singapore’s approval.

SGX Discovery Series with GEM COMM

Offshore Energy – Powering a New Tomorrow

Date: Wednesday, 16 October 2024 | Time: 7:00pm – 8:30pm SGT

Venue: SGX Auditorium, Level 2, 2 Shenton Way, SGX Centre 1, Singapore 068804

Overview

As the world transitions away from fossil fuels, offshore energy offers promising solutions to meet growing energy demands while significantly reducing our carbon footprint.

Discover the untapped potential of offshore energy and its pivotal role in shaping a sustainable future. From harnessing the power of the wind and waves to exploring ocean depth for renewable resources, the offshore energy sector is the next frontier of innovation.

Join us with our distinguished speakers from Sheffield Green, Marco Polo Marine, Mermaid Maritime, and GEM COMM, as we discuss the sector’s outlook, and how companies within the sector can benefit from the global energy transition.

Industries: Offshore wind, wave power, energy infrastructure

Featured ListCos: Marco Polo Marine, Mermaid Maritime, Sheffield Green

Event Details

Date: Wednesday, 16 October 2024

Time: 7.00pm – 8.30pm

Venue: SGX Auditorium, Level 2, 2 Shenton Way, SGX Centre 1, Singapore 068804

A reminder email will be sent one day before the event.

Dress Code: Smart Casual

RSVP: Admission is free, Registration is required

Speakers

Programme

| Time | Session |

|---|---|

| 6.30pm | Registration |

| 7.00pm | Market/Sector Outlook – Mr. Royston Tan, Head of Research, GEM COMM |

| 7.20pm | Harnessing the Power of Wind: Marco Polo Marine’s Commitment to a Sustainable Future – Mr. Sean Lee Yun Feng, CEO of Marco Polo Marine |

| 7.35pm | Unlocking the Depths: How Mermaid Maritime is Driving Efficiency in Subsea Operations – Mr. Paul Whiley, COO and Executive Director of Mermaid Maritime |

| 7.50pm | Fuelling the Renewable Energy Future: Sheffield Green’s Leadership in Global HR Solutions – Mr. Bryan Kee Boo Chye, CEO, Chairman, and Executive Director of Sheffield Green |

| 8.05pm | Panel Discussion + Combined Q&A |

| 8.30pm | End of Programme |

*Sessions and timings may be subject to change.

This event may be subject to audio and video recording and photography, which SGX may use for internal and external publicity, and share with participants for commemorative purposes.

By providing my personal information herewith, I consent and authorize Singapore Exchange Limited (“SGX”) and/or its affiliates (collectively with SGX, the “SGX Group Companies”) to process, collect, use, disclose and store the information I have provided (including personal data) for security checks & monitoring in relation to SGX’s premises or premises managed by SGX and contacting me for emergency purposes.

Please visit SGX Privacy Policy for information on SGX’s data protection policy.

Link to Report:

Maybank_Dyna-Mac_1H24

🌟BROKER’S Updates🌟

Maybank Analyst: Jarick Seet

Dyna-Mac – Explosive 1H24 🇸🇬⛴️⚓️🛢️ ( DHML SP , BUY , TP 0.64 ⬆️ from SGD0.62 )

“Dyna-Mac’s 1H24 results are spectacular, with revenue rising 43% YoY to SGD260m and NPAT up 280% YoY to SGD39m, achieving 66% of our FY24 forecasts, led by a surge in gross profit margin from 13.5% to 27.6% as well as solid revenue growth. We raise our FY24E PATMI by 3.6% and FY25E by 3.7% and increase our TP to SGD0.64 from SGD0.62, based on 13x FY24E P/E. Dyna-Mac is a key beneficiary of the multi-year FPSO upcycle and remains one of our Top Picks in the SMID space.”

FPSO Future Ready-Rystad Report

10 Questions for Sheffield Green

1. What is Sheffield Green’s business about, and could you describe the Group’s key business segments?

2. What are the market opportunities for Sheffield Green?

3. Describe the current market dynamics of the renewable energy industry. How is Sheffield Green positioned in this industry?

4. Why focus on this segment – Engineering, Procurement, Construction and Installation (EPCI) works in the renewable energy industry?

5. Tell us more about the training centre being set up in Taiwan and how it fits into Sheffield Green’s strategy.

6. Could you update us on the progress of Sheffield Green’s operations and activities in the various geographies?

7. What are some of Sheffield Green’s competitive advantages that set it apart from its peers?

8. Could you share some of the key ESG factors that are material to your company and how that can create long-term value for your shareholders?

9. What are the mid- to long-term catalysts for Sheffield Green?

10. What is Sheffield Green’s value proposition for its shareholders and potential investors? What do you think investors have overlooked?

10 in 10 – 10 Questions in 10 Minutes with SGX-listed companies

Designed to be a short read, 10 in 10 provides insights into SGX-listed companies through a series of 10 Q&As with management. Through these Q&As, management will discuss current business objectives, key revenue drivers as well as the industry landscape. Expect to find wide-ranging topics that go beyond usual company financials.

This report contains factual commentary from the company’s management and is based on publicly announced information from the company.

For more, visit www.sgx.com/research-education

For more company information, visit www.sheffieldgreen.com

Click here for Sheffield Green’s 1H24 results.

Enjoying this read?