My Cart 0

My Cart 0

Niks Professional Ltd., an established family-practice dermatology and aesthetic medical services provider in Singapore, is going for a Catalist listing after lodging its preliminary offer document on Friday (Sep 29).

In this article, we will take a quick look at 7 key things you need to know about Niks Professional.

Niks Professional Business Model

According to the prospectus, Niks Professional stated that it is a trusted and established family-practice dermatology and aesthetic medical services provider with an operating history of more than 25 years that also offers a comprehensive range of medical skincare products and salon services to complement medical solutions.

At the time of IPO, Niks Professional has 3 clinics and 3 outlets retailing Niks skincare products and offering facial services in Singapore as illustrated in the map below:

Over at the clinic, the doctors typically offer 2 types of services: family-practice dermatology services and aesthetic medical services:

- Family-practice dermatology – common skin conditions treated are acne, acne scar treatment, hyperhidrosis and eczema, and they are treated through a combination of medication, skincare products and medical procedures.

- Aesthetic medical services – provide non-invasive and minimally invasive aesthetic medical services, including intense pulsed light treatment, lasers and injectable treatments like Botox, and Rejuran for anti-aging and contouring of the face and skin.

Niks clinics’ strength in family-practice dermatology sets them apart from “pure aesthetic clinics” which offer mostly medical cosmetic services like injections and aesthetic lasers. The Group believes that this renders their clinics’ revenues less vulnerable to economic downturns and disruptions.

On top of that, the company operates an e-commerce platform selling to customers as well as supply them to some third-party medical clinics and beauty salons. As at the Latest Practical Date, the Group offers more than 100 unique proprietary medical skincare products under 5 broad categories for a more targeted approach to improve skin conditions namely:

- body care, sun care and camouflage

- dry and sensitive skin;

- general skincare

- oily, combination and acne-prone skin; and

- pigmentation, photo-damage and anti-aging

Through its Shanghai subsidiary, NPSCL, Niks Professional distributes skincare products to 11 regional agents in the PRC, which in turn supply the products to hospitals, clinics, pharmacies, retail shops, doctors and consumers in their provinces and municipalities.

NPSCL also sells directly to some doctors and doctor groups, as well as to consumers via e-commerce through a WeChat mini-program and www.haodf.com, a telemedicine platform in the PRC.

In short, Niks Professional can be considered as a one-stop solutions provider for a wide range of dermatological issues.

Use of IPO Proceeds and Growth Plans

The net proceeds of S$3.3 million from the IPO will be used in the following ways:

- Organic growth through opening of new clinics and outlets

- Recruitment of healthcare and management professionals

- Purchase of new equipment

- Expansion of its medical skincare products distribution business in China

- Expansion of business through acquisitions, JV and/or strategic alliances with parties whose businesses are synergistic or complementary with Niks business.

For the 1st point, Niks has revealed that it plans to set up 1 clinic in the North and 1 outlet in the West of Singapore.

As for its business in China, Niks plans to engage with doctors and end-users for direct sales of its products as this commands better margins than relying on its agents. This includes recruitment of staff with marketing expertise in China.

Niks Professional Financial Performance

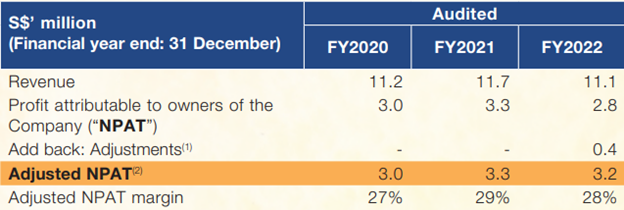

Despite operating under a challenging COVID-19 environment, Niks Professional was able to generate revenue consistently above S$11.0 million from FY2020 to FY2022.

Adding back the one-off listing expenses, we can also see that the adjusted net profits after tax is maintained at above S$3 million, in line with its stable revenue trend.

In addition, the Group boasts of a strong balance sheet as it is a net-cash company with no borrowings at all. On top of that, it owns 3 leasehold properties with a book value of S$9.4 million under its ‘Property, plant and equipment’ segment.

The properties are AMK Shophouse, Bedok Shophouse and Vision Exchange Property, with a total area of 4,079 sq ft, and used primarily for retail and salon or medical clinic operations.

Last but not least, we can see that Niks Professional possesses a with minimal capital expenditure as seen from their ‘net cash from investing activities’ in the past 3 years.

Niks Professional is a Tight-Knit, Family-Run Medical Group

Founded in 1998 by a husband-and-wife team, the company has 3 clinics across Singapore: in Orchard, Jurong East and Tampines. Its 5 doctors offer medical consultation and services such as light and laser procedures, injectables and mole removals.

The company is led by co-founder Cheng Shoong Tat, who holds the chairman and chief executive officer positions. His wife, Dr Ong Fung Chin, started her own clinic in 1994 and serves as Niks Professional’s president and chief medical officer.

Mr. Cheng and Dr. Ong are Niks Professional’s main shareholders and shall remain as its directors.

Why Should Investors Be Interested In Niks Professional IPO

While there are many healthcare stocks listed on SGX like Raffles Medical or Q&M Dental, there is none dedicated to skincare/dermatology.

In fact, Niks Professional stands out from the rest due to its strong brand reputation – it offers more than 100 unique proprietary medical skincare products under the “Niks” brand. These products are also formulated by its own doctors for a more targeted approach to improve patient skin conditions.

On top of that, all the doctors in the company are general practitioners with qualifications or experience in dermatology, with an average of two decades of experience.

Last but not least, the Group has established a strong foothold in 2 markets –

- Singapore, where it has evolved from a single-family clinic to 3 clinics and 3 outlets now together with a range of more than 100 skincare products; and

- China, where it has built up a network of 11 regional sales agents, selling to healthcare facilities, doctors and consumers in 13 provinces and 1 city

With this firm foundation, Niks Professional is now ready to fuel the next phase of its growth through the IPO funds.

Niks Professional IPO Details

A total of 21.8 million shares will be offered at $0.23 each. Only 1.0 million, or about 4.5% of the shares will be for retail investors, while the remaining is set aside for placement shares.

For those interested to invest in Niks Professional’s IPO, you can invest via the following methods:

- ATMs and internet banking websites of UOB, DBS and OCBC

- Mobile banking interfaces of UOB and DBS

- Online portals of iFast Financial Pte Ltd

- The “printed WHITE Public Offer Application Form”

Applications for this IPO will be open on 18 October, and will close on 25 October (Wednesday) at 12 noon.

Niks Professional IPO Valuation and Dividend Policy

Taking the IPO price of S$0.23 and Adjusted EPS of S$0.0242, the P/E ratio comes up to a pretty cheap 9.5x if you were to compare to other listed medical stocks.

While Niks Professional revealed that it does not adopt a formal dividend policy, it plans to recommend not less than 50% in net profits in 2023 and not less than 40% in net profits in 2024 in dividends to reward its shareholders.

Conclusion

In conclusion, Niks Professional’s diversified business model and expansion plans in Singapore and China presents a compelling investment opportunity for investors looking to tap on growing demand for skincare and dermatology services.

Niks Professional Ltd., an established family-practice dermatology and aesthetic medical services provider in Singapore, is going for a Catalist listing after lodging its preliminary offer document on Friday (Sep 29).In this article, we will take a quick look at 7 key things you need to know about Niks Professional.

Niks Professional Business Model

According to the prospectus, Niks Professional stated that it is a trusted and established family-practice dermatology and aesthetic medical services provider with an operating history of more than 25 years that also offers a comprehensive range of medical skincare products and salon services to complement medical solutions.

At the time of IPO, Niks Professional has 3 clinics and 3 outlets retailing Niks skincare products and offering facial services in Singapore as illustrated in the map below:

Over at the clinic, the doctors typically offer 2 types of services: family-practice dermatology services and aesthetic medical services:

- Family-practice dermatology – common skin conditions treated are acne, acne scar treatment, hyperhidrosis and eczema, and they are treated through a combination of medication, skincare products and medical procedures.

- Aesthetic medical services – provide non-invasive and minimally invasive aesthetic medical services, including intense pulsed light treatment, lasers and injectable treatments like Botox, and Rejuran for anti-aging and contouring of the face and skin.

Niks clinics’ strength in family-practice dermatology sets them apart from “pure aesthetic clinics” which offer mostly medical cosmetic services like injections and aesthetic lasers. The Group believes that this renders their clinics’ revenues less vulnerable to economic downturns and disruptions.

On top of that, the company operates an e-commerce platform selling to customers as well as supply them to some third-party medical clinics and beauty salons. As at the Latest Practical Date, the Group offers more than 100 unique proprietary medical skincare products under 5 broad categories for a more targeted approach to improve skin conditions namely:

- body care, sun care and camouflage

- dry and sensitive skin;

- general skincare

- oily, combination and acne-prone skin; and

- pigmentation, photo-damage and anti-aging

Through its Shanghai subsidiary, NPSCL, Niks Professional distributes skincare products to 11 regional agents in the PRC, which in turn supply the products to hospitals, clinics, pharmacies, retail shops, doctors and consumers in their provinces and municipalities.

NPSCL also sells directly to some doctors and doctor groups, as well as to consumers via e-commerce through a WeChat mini-program and www.haodf.com, a telemedicine platform in the PRC.

In short, Niks Professional can be considered as a one-stop solutions provider for a wide range of dermatological issues.

Use of IPO Proceeds and Growth Plans

The net proceeds of S$3.3 million from the IPO will be used in the following ways:

- Organic growth through opening of new clinics and outlets

- Recruitment of healthcare and management professionals

- Purchase of new equipment

- Expansion of its medical skincare products distribution business in China

- Expansion of business through acquisitions, JV and/or strategic alliances with parties whose businesses are synergistic or complementary with Niks business.

For the 1st point, Niks has revealed that it plans to set up 1 clinic in the North and 1 outlet in the West of Singapore.

As for its business in China, Niks plans to engage with doctors and end-users for direct sales of its products as this commands better margins than relying on its agents. This includes recruitment of staff with marketing expertise in China.

Niks Professional Financial Performance

Despite operating under a challenging COVID-19 environment, Niks Professional was able to generate revenue consistently above S$11.0 million from FY2020 to FY2022.

Adding back the one-off listing expenses, we can also see that the adjusted net profits after tax is maintained at above S$3 million, in line with its stable revenue trend.

In addition, the Group boasts of a strong balance sheet as it is a net-cash company with no borrowings at all. On top of that, it owns 3 leasehold properties with a book value of S$9.4 million under its ‘Property, plant and equipment’ segment.

The properties are AMK Shophouse, Bedok Shophouse and Vision Exchange Property, with a total area of 4,079 sq ft, and used primarily for retail and salon or medical clinic operations.

Last but not least, we can see that Niks Professional possesses a with minimal capital expenditure as seen from their ‘net cash from investing activities’ in the past 3 years.

Niks Professional is a Tight-Knit, Family-Run Medical Group

Founded in 1998 by a husband-and-wife team, the company has 3 clinics across Singapore: in Orchard, Jurong East and Tampines. Its 5 doctors offer medical consultation and services such as light and laser procedures, injectables and mole removals.

The company is led by co-founder Cheng Shoong Tat, who holds the chairman and chief executive officer positions. His wife, Dr Ong Fung Chin, started her own clinic in 1994 and serves as Niks Professional’s president and chief medical officer.

Mr. Cheng and Dr. Ong are Niks Professional’s main shareholders and shall remain as its directors.

Why Should Investors Be Interested In Niks Professional IPO

While there are many healthcare stocks listed on SGX like Raffles Medical or Q&M Dental, there is none dedicated to skincare/dermatology.

In fact, Niks Professional stands out from the rest due to its strong brand reputation – it offers more than 100 unique proprietary medical skincare products under the “Niks” brand. These products are also formulated by its own doctors for a more targeted approach to improve patient skin conditions.

On top of that, all the doctors in the company are general practitioners with qualifications or experience in dermatology, with an average of two decades of experience.

Last but not least, the Group has established a strong foothold in 2 markets –

- Singapore, where it has evolved from a single-family clinic to 3 clinics and 3 outlets now together with a range of more than 100 skincare products; and

- China, where it has built up a network of 11 regional sales agents, selling to healthcare facilities, doctors and consumers in 13 provinces and 1 city

With this firm foundation, Niks Professional is now ready to fuel the next phase of its growth through the IPO funds.

Niks Professional IPO Details

A total of 21.8 million shares will be offered at $0.23 each. Only 1.0 million, or about 4.5% of the shares will be for retail investors, while the remaining is set aside for placement shares.

For those interested to invest in Niks Professional’s IPO, you can invest via the following methods:

- ATMs and internet banking websites of UOB, DBS and OCBC

- Mobile banking interfaces of UOB and DBS

- Online portals of iFast Financial Pte Ltd

- The “printed WHITE Public Offer Application Form”

Applications for this IPO will be open on 18 October, and will close on 25 October (Wednesday) at 12 noon.

| Opening Date and Time | 18 October 2023 at 6 p.m. |

| Closing Date and Time | 25 October 2023 at 12 noon |

| Commence trading | 27 October 2023 at 9 a.m. |

Niks Professional IPO Valuation and Dividend Policy

Taking the IPO price of S$0.23 and Adjusted EPS of S$0.0242, the P/E ratio comes up to a pretty cheap 9.5x if you were to compare to other listed medical stocks.

While Niks Professional revealed that it does not adopt a formal dividend policy, it plans to recommend not less than 50% in net profits in 2023 and not less than 40% in net profits in 2024 in dividends to reward its shareholders.

Conclusion

In conclusion, Niks Professional’s diversified business model and expansion plans in Singapore and China presents a compelling investment opportunity for investors looking to tap on growing demand for skincare and dermatology services.

Human resources provider Sheffield Green is seeking to raise over S$6 million through a Catalist IPO on the Singapore Exchange.

The counter is expected to begin trading on 30 Oct and its market capitalization will be S$46.6 million upon listing.

Looking for a company to tap on the clean energy wave? Then you need to read the 7 quick things to know about Sheffield Green below…

About Sheffield Green

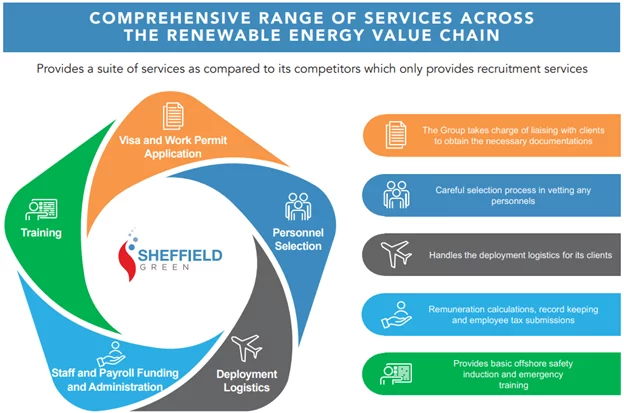

Headquartered in Singapore with subsidiaries incorporated in Singapore, Japan and a branch office in Taiwan, Sheffield Green provides 2 main segments of HR solutions namely:

- Provision of human resource services – Able to supply a wide range of personnel in accordance with its clients ranging from management personnel (including C-suite personnel), technical personnel, to offshore crewing personnel across industry sub-segments.

- Ancillary Services – The Group provides a range of end-to-end ancillary services related to the provision of personnel, which include primarily visa and work permit applications, training and deployment logistics.

As seen from the picture above, Sheffield Green stands out among its competitors in that it offers a suite of services such as handling the deployment logistics for clients and even basic offshore training as compared to firms who only provide recruitment services.

Incorporated in Singapore in 2021, Sheffield Green is the renewable energy spin-off of Sheffield Energy – a global recruitment company formed over 30 years ago.

Sheffield Green IPO Details

A total of 24 million shares will be offered at $0.25 each, of which 3.6 million will be catered for retail investors, while the remaining is set aside for placement shares.

For those interested to invest in Sheffield Green’s IPO, you can invest via the following methods:

- ATMs and internet banking websites of DBS and POSB

- Mobile banking interfaces of DBS and POSB

- The “printed WHITE Public Offer Application Form”

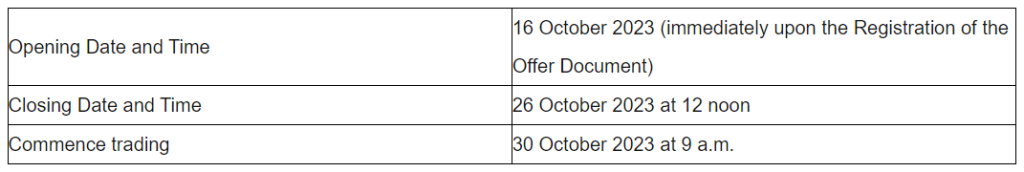

Applications for this IPO will be open on 16 October, and will end on 26 October (Thursday) at 12 noon.

Use of IPO Proceeds and Growth Plans

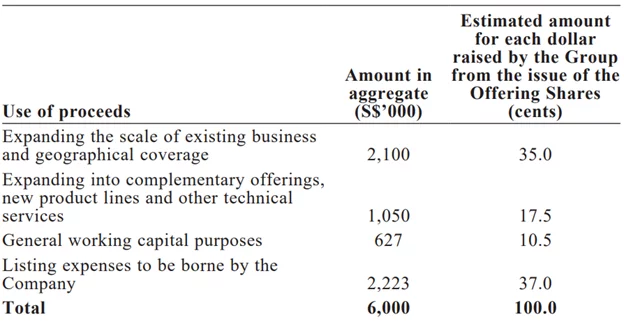

The estimated net proceeds to be raised from the Offering, after deducting the IPO expenses of S$2.2 million (37%), amount to an approximate S$3.8 million.

Sheffield Green plans to utilize around S$2.1 million (35% of the IPO proceeds) to set up new overseas offices and expand its geographical presence in locations where there are significant renewable energy related activities.

Next, Sheffield Green intends to allocate around S$1 million to expand its complementary offerings to better serve its clients. Some of the initiatives include:

- Developing and operating in-house capabilities to minimize reliance on third-party service providers

- Explore acquisition and/or strategic partnership opportunities with 3rd-party services providers such as industry trainers, immigration and travel logistics solutions providers

- Diversify its staffing solutions segment by providing services further along the value chain, such as providing relevant technical services to its clients such that the client does not have to manage the employees directly

For instance, the Group already has plans to establish training schools and centres in Taiwan to conduct lessons for renewable energy personnel within an estimated 1 year from the listing date.

On top of that, according to an interview with the Business Times, the company plans to open an office in Poland by November 2023 and another one in Boston, United States by 1Q2024, given that work has begun on its first offshore wind project in New York.

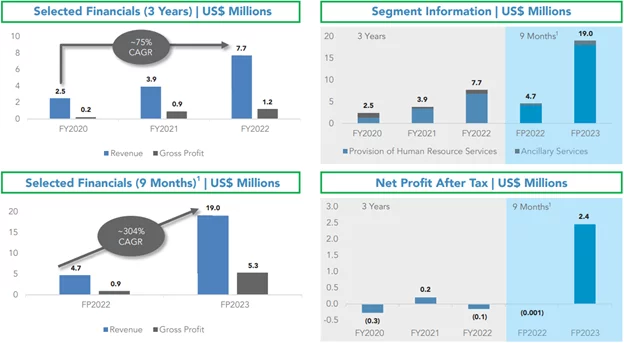

Sheffield Green Financial Performance

Sheffield Green saw its revenue skyrocket from US$2.5 million in FY2020 to US$7.7 million in FY2022, translating into a ~75% compounded annual growth rate. The sharp revenue jump in FY2022 can be attributed to 2 main reasons:

- Securing of new projects in FY2022: 2 in Taiwan, 6 in France and 1 in Japan and

- Increase in personnel for the existing projects in Taiwan and France

One important thing to note is that in the first 9M FY2023, the company saw its revenue hit US$19.04 million, 4x that of US$4.7 million sales generated in the past one year.

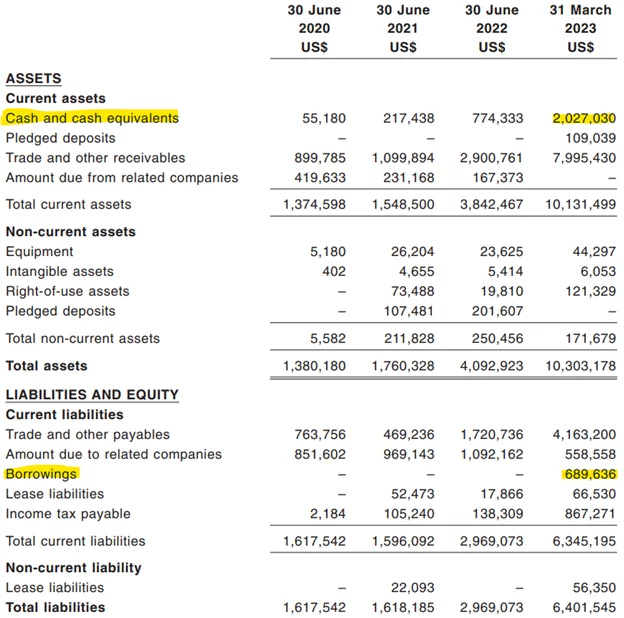

Sheffield Green also possesses a pristine financial position as its cash and cash equivalents can more than cover the borrowings as of March 2023.

How “Sheffield Green” was spun off from the Parent Company

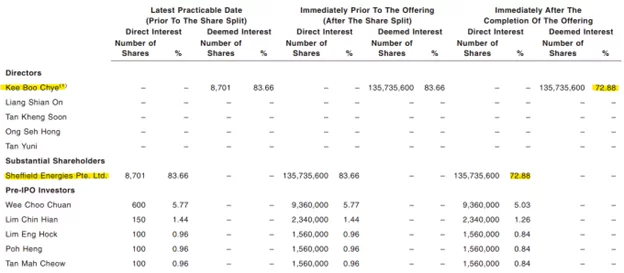

Post-IPO, Sheffield Green’s Chairman and CEO Mr. Kee Boo Chye will be the controlling shareholder with an approximately 72.88% deemed stake in the firm by virtue of his 58.35% interest in the parent company – Sheffield Energies Pte. Ltd as highlighted in the picture above.

Mr. Kee Boo Chye who has now over 20 years of experience in the business of providing HR services in the energy sector, founded “Sheffield Energies” around year 2000. Back then, the company was focused on providing manpower, staffing and human resource services in the oil & gas and marine industry.

Around the year 2015, Mr. Kee Boo Chye expanded the business of Sheffield Energies towards the provision of such services in the renewable energy industry in Europe underpinned by the growing global emphasis on achieving a carbon-neutral vision and the transition towards sustainable and renewable energy sources.

The Renewable Energy Business futher expanded to Taiwan and Japan in 2018 and 2021 respectively in order to capitalize on increasing support for the renewable energy by the government authorities.

After which, Mr. Kee Boo Chye decided to carve out the Renewable Energy Business from the holding company to allow the Group to be more strategically positioned to benefit from the developing trends in the renewable energy industry.

How Sheffield Green can leverage on the renewable energy boom

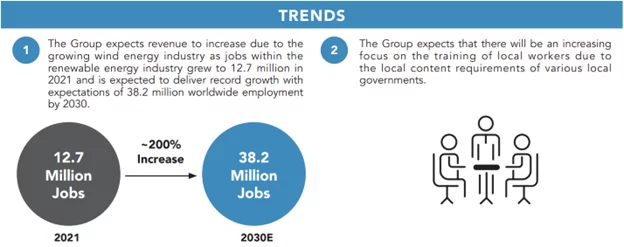

According to its prospectus, IEA predicts that the drive towards renewable energy capacity expansion will inevitably increase demand for renewable energy employment. Based on the industry research, the firm expects revenue to grow as the wind energy sector expands, with jobs in the renewable energy industry set to triple from 12.7 million in 2021 to 38.2 million worldwide by 2030.

In addition, there is one pressing problem faced by many renewable companies – a lack of experienced personnel in this new sector. Hence, Sheffield Green hopes to tap on the increased focus on the training of local workers by setting up various overseas offices.

Sheffield Green IPO Valuation and Dividend Policy

If we were to annualize the 9M FY2023 EPS of 1.32 Singapore cents post-IPO, the FY2023 forward EPS will be 1.76 Singapore cents.

The forward FY2023 P/E ratio is calculated to be 14.2x based on the IPO price of S$0.25.

While Sheffield Green revealed that it does not adopt a formal dividend policy, it plans to recommend not less than 30% in net profits for FY2023 to FY2024 to reward its shareholders.

Conclusion

To end off, governments worldwide are increasingly advocating for sustainability, implementing policies to promote renewable energy adoption and address environmental concerns.

Hence, Sheffield Green IPO comes at an opportune time to leverage on this trend as more companies are incentivized to hire more personnel trained in this field across the globe.

Looking for a company to tap on the clean energy wave? Then you need to read the 7 quick things to know about Sheffield Green below…

About Sheffield Green

Headquartered in Singapore with subsidiaries incorporated in Singapore, Japan and a branch office in Taiwan, Sheffield Green provides 2 main segments of HR solutions namely:

- Provision of human resource services – Able to supply a wide range of personnel in accordance with its clients ranging from management personnel (including C-suite personnel), technical personnel, to offshore crewing personnel across industry sub-segments.

- Ancillary Services – The Group provides a range of end-to-end ancillary services related to the provision of personnel, which include primarily visa and work permit applications, training and deployment logistics.

As seen from the picture above, Sheffield Green stands out among its competitors in that it offers a suite of services such as handling the deployment logistics for clients and even basic offshore training as compared to firms who only provide recruitment services.

Incorporated in Singapore in 2021, Sheffield Green is the renewable energy spin-off of Sheffield Energy – a global recruitment company formed over 30 years ago.

Sheffield Green IPO Details

A total of 24 million shares will be offered at $0.25 each, of which 3.6 million will be catered for retail investors, while the remaining is set aside for placement shares.

For those interested to invest in Sheffield Green’s IPO, you can invest via the following methods:

- ATMs and internet banking websites of DBS and POSB

- Mobile banking interfaces of DBS and POSB

- The “printed WHITE Public Offer Application Form”

Applications for this IPO will be open on 16 October, and will end on 26 October (Thursday) at 12 noon.

| Opening Date and Time | 16 October 2023 (immediately upon the Registration of the Offer Document) |

| Closing Date and Time | 26 October 2023 at 12 noon |

| Commence trading | 30 October 2023 at 9 a.m. |

Use of IPO Proceeds and Growth Plans

The estimated net proceeds to be raised from the Offering, after deducting the IPO expenses of S$2.2 million (37%), amount to an approximate S$3.8 million.

Sheffield Green plans to utilize around S$2.1 million (35% of the IPO proceeds) to set up new overseas offices and expand its geographical presence in locations where there are significant renewable energy related activities.

Next, Sheffield Green intends to allocate around S$1 million to expand its complementary offerings to better serve its clients. Some of the initiatives include:

- Developing and operating in-house capabilities to minimize reliance on third-party service providers

- Explore acquisition and/or strategic partnership opportunities with 3rd-party services providers such as industry trainers, immigration and travel logistics solutions providers

- Diversify its staffing solutions segment by providing services further along the value chain, such as providing relevant technical services to its clients such that the client does not have to manage the employees directly

For instance, the Group already has plans to establish training schools and centres in Taiwan to conduct lessons for renewable energy personnel within an estimated 1 year from the listing date.

On top of that, according to an interview with the Business Times, the company plans to open an office in Poland by November 2023 and another one in Boston, United States by 1Q2024, given that work has begun on its first offshore wind project in New York.

Sheffield Green Financial Performance

Sheffield Green saw its revenue skyrocket from US$2.5 million in FY2020 to US$7.7 million in FY2022, translating into a ~75% compounded annual growth rate. The sharp revenue jump in FY2022 can be attributed to 2 main reasons:

- Securing of new projects in FY2022: 2 in Taiwan, 6 in France and 1 in Japan and

- Increase in personnel for the existing projects in Taiwan and France

One important thing to note is that in the first 9M FY2023, the company saw its revenue hit US$19.04 million, 4x that of US$4.7 million sales generated in the past one year.

Sheffield Green also possesses a pristine financial position as its cash and cash equivalents can more than cover the borrowings as of March 2023.

How “Sheffield Green” was spun off from the Parent Company

Post-IPO, Sheffield Green’s Chairman and CEO Mr. Kee Boo Chye will be the controlling shareholder with an approximately 72.88% deemed stake in the firm by virtue of his 58.35% interest in the parent company – Sheffield Energies Pte. Ltd as highlighted in the picture above.

Mr. Kee Boo Chye who has now over 20 years of experience in the business of providing HR services in the energy sector, founded “Sheffield Energies” around year 2000. Back then, the company was focused on providing manpower, staffing and human resource services in the oil & gas and marine industry.

Around the year 2015, Mr. Kee Boo Chye expanded the business of Sheffield Energies towards the provision of such services in the renewable energy industry in Europe underpinned by the growing global emphasis on achieving a carbon-neutral vision and the transition towards sustainable and renewable energy sources.

The Renewable Energy Business futher expanded to Taiwan and Japan in 2018 and 2021 respectively in order to capitalize on increasing support for the renewable energy by the government authorities.

After which, Mr. Kee Boo Chye decided to carve out the Renewable Energy Business from the holding company to allow the Group to be more strategically positioned to benefit from the developing trends in the renewable energy industry.

How Sheffield Green can leverage on the renewable energy boom

According to its prospectus, IEA predicts that the drive towards renewable energy capacity expansion will inevitably increase demand for renewable energy employment. Based on the industry research, the firm expects revenue to grow as the wind energy sector expands, with jobs in the renewable energy industry set to triple from 12.7 million in 2021 to 38.2 million worldwide by 2030.

In addition, there is one pressing problem faced by many renewable companies – a lack of experienced personnel in this new sector. Hence, Sheffield Green hopes to tap on the increased focus on the training of local workers by setting up various overseas offices.

Sheffield Green IPO Valuation and Dividend Policy

If we were to annualize the 9M FY2023 EPS of 1.32 Singapore cents post-IPO, the FY2023 forward EPS will be 1.76 Singapore cents.

The forward FY2023 P/E ratio is calculated to be 14.2x based on the IPO price of S$0.25.

While Sheffield Green revealed that it does not adopt a formal dividend policy, it plans to recommend not less than 30% in net profits for FY2023 to FY2024 to reward its shareholders.

Conclusion

To end off, governments worldwide are increasingly advocating for sustainability, implementing policies to promote renewable energy adoption and address environmental concerns.

Hence, Sheffield Green IPO comes at an opportune time to leverage on this trend as more companies are incentivized to hire more personnel trained in this field across the globe.